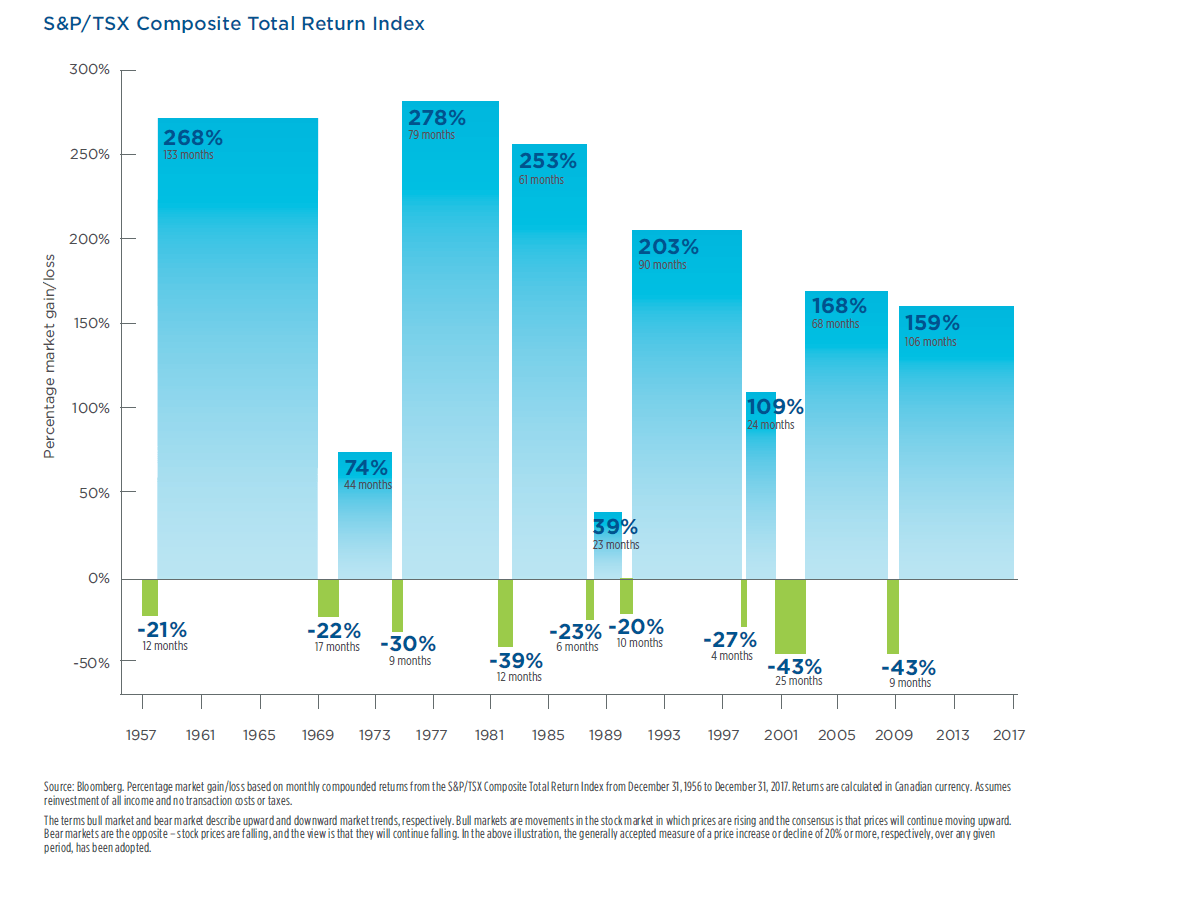

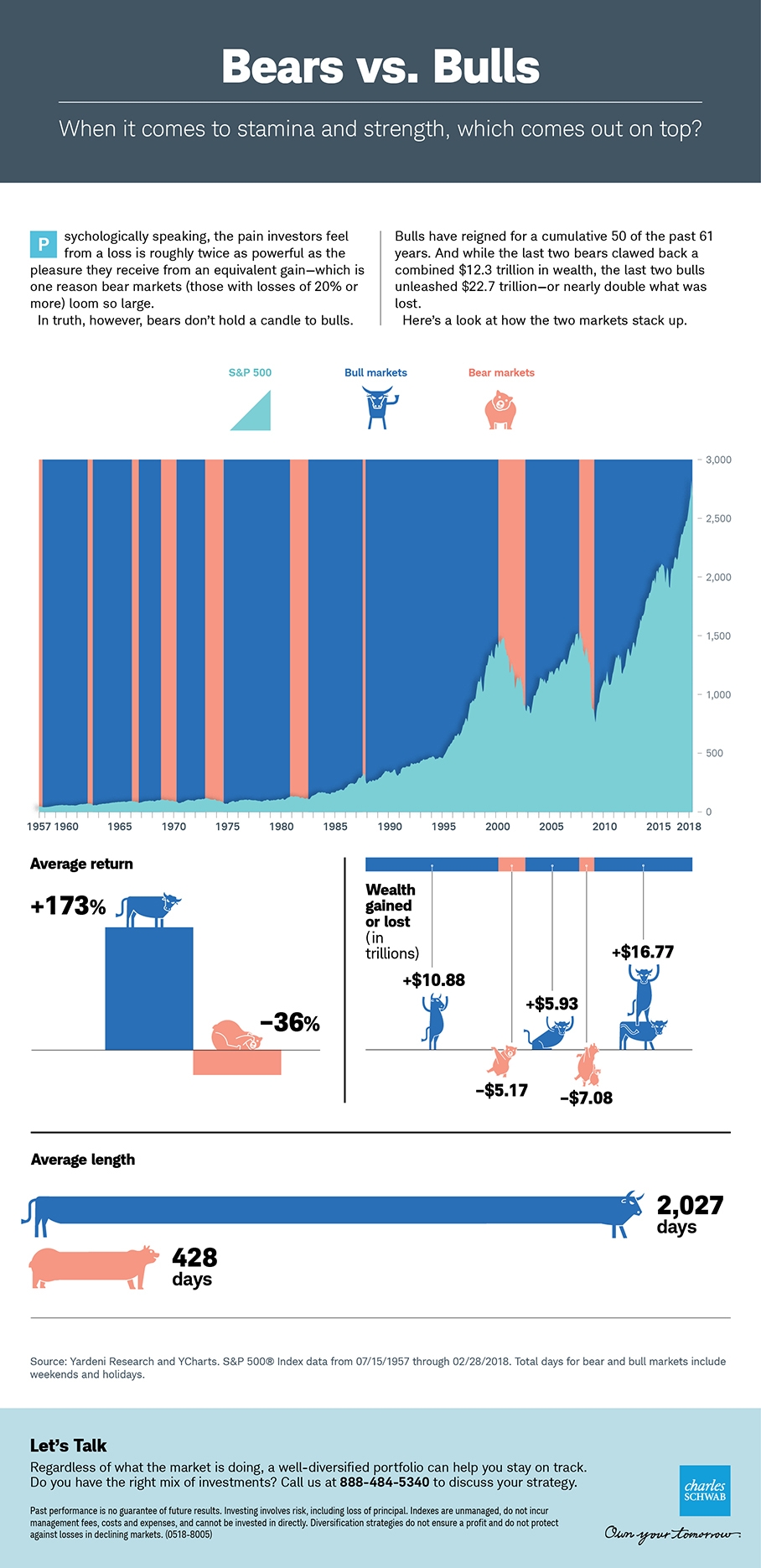

There have been nine bull and bear markets in the Canadian equity market since 1957. Like in other countries, bull markets have been longer than bear markets with the average bull market lasting 70 months with an average return of over 141%. Similarly the average bear market lasted about 12 months with an average loss of over 30%.

Click to enlarge

Source: Dynamic Funds, Canada