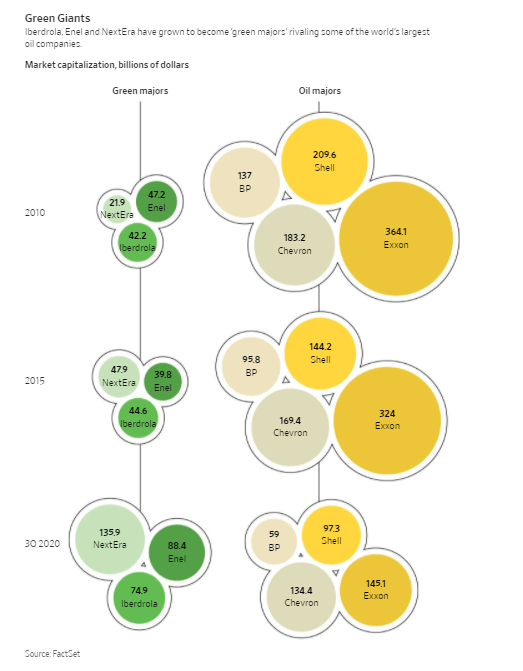

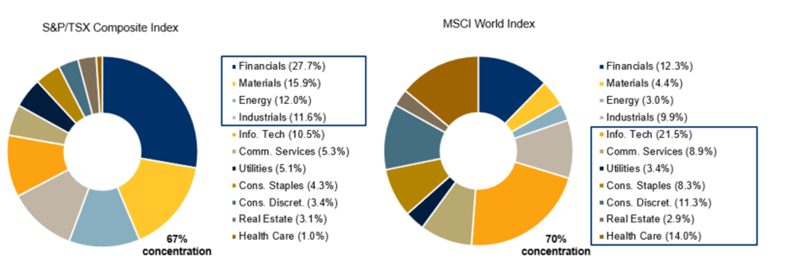

Renewable energy companies are growing fast in the past few years while the oil companies are struggling. The pandemic dealt drove demand for oil to unheard of levels dealing another blow to the oil firms. The Wall Street Journal published an article over the weekend discussing the rise of the “green energy majors” and how they are competing against the established oil majors. Below is a short excerpt from the piece:

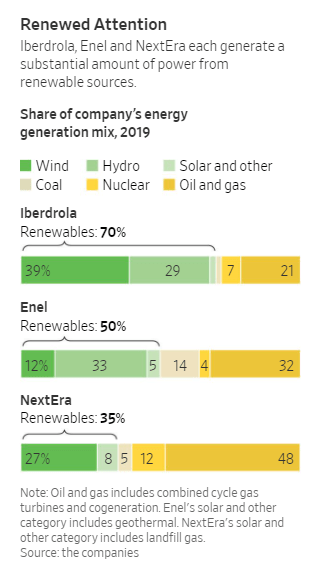

For now, NextEra, Enel SpA and Iberdrola SA are Wall Street darlings, after Spain’s Iberdrola and Italy’s Enel became global builders of green energy projects, while NextEra became America’s largest generator of wind and solar power.

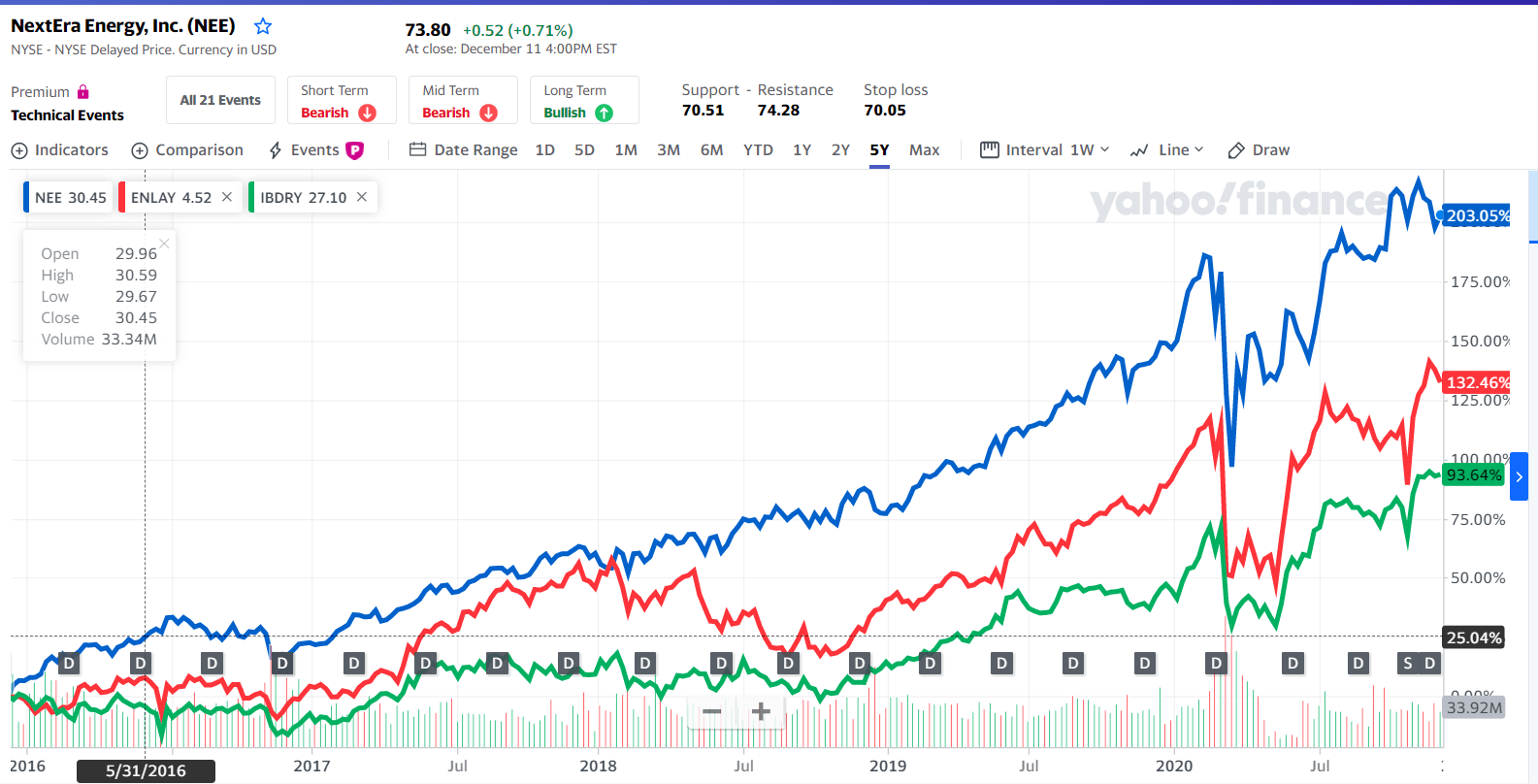

Each of the companies has seen its share price soar in recent months as investors bet on their ability to lead the transition to a lower-carbon future with massive investments in renewable energy, battery storage and improvements to the electric grid.

That transition is expected to accelerate in the U.S. under President-elect Joe Biden, who has promised to focus on climate change, and within the European Union and China, where ambitious carbon-reduction efforts are under way.

Enel and Iberdrola have outlined plans to substantially expand their portfolios of renewable-energy projects over the next decade with about $170 billion in collective investments. NextEra, which hasn’t disclosed a long-term spending plan, expects to have invested $60 billion in renewable energy projects between 2019 and 2022.

Still, analysts caution that increased competition within the renewables industry could reduce profit margins for the most established players.

Click to enlarge

Source: The New Green Energy Giants Challenging Exxon and BP, WSJ

Related Stocks:

The 5-year return of the above stocks are shown in the chart below:

Source: Yahoo Finance

Disclosure: Long NEE