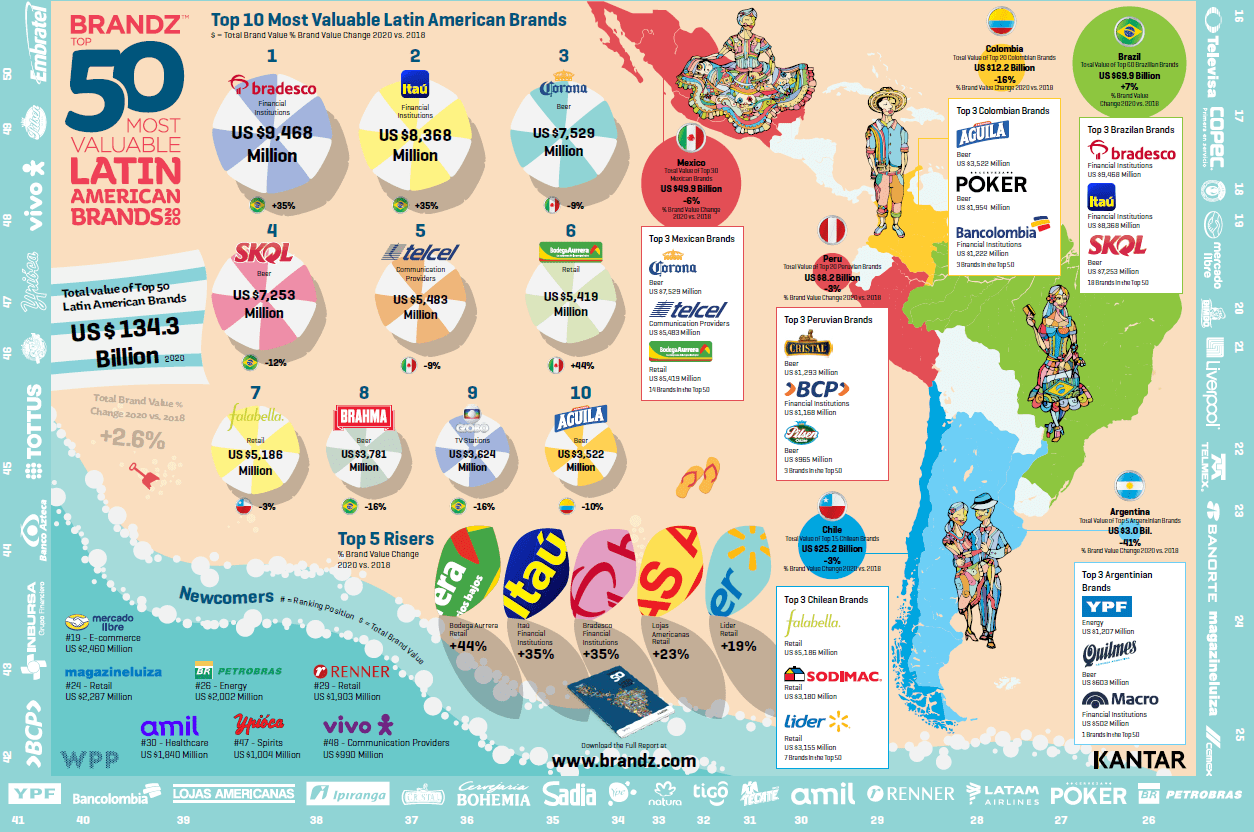

The Top 50 Most Valuable Brands in Latin America for 2020 is shown in the graphic below. The most valuable brand in the continent is Brazilian banking group Bradesco(BBD). Corona beer is the top brand in Mexico. In Peru, BCP bank (BAP) is among the top 3 brands. Similarly in Colombia, Bancolombia(CIB) is also a top 3 brand.

Click to enlarge

Source: Brandz

Disclosure: Long BBD