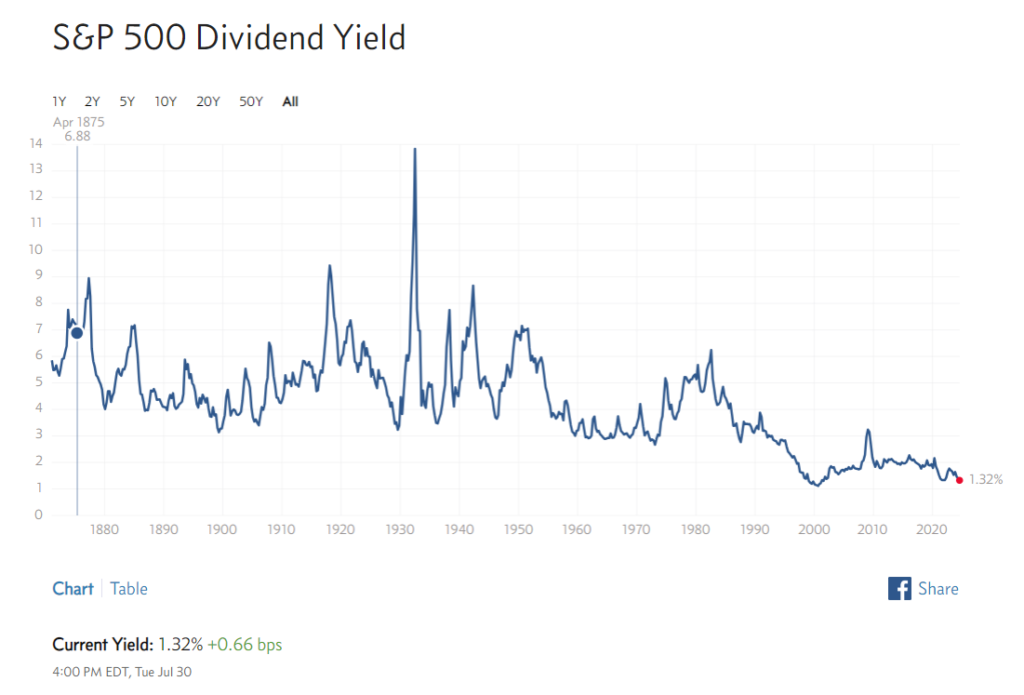

The U.S. lags many regions of the world in terms of dividend yields. Hence investors looking for income can find better opportunities outside of the country. The dividend yields on US stocks have been on the decline for many years now due to tax policy and other factors. Currently the yield on the S&P 500 is just 1.32% as shown in the chart below:

Click to enlarge

Source: multpl.com

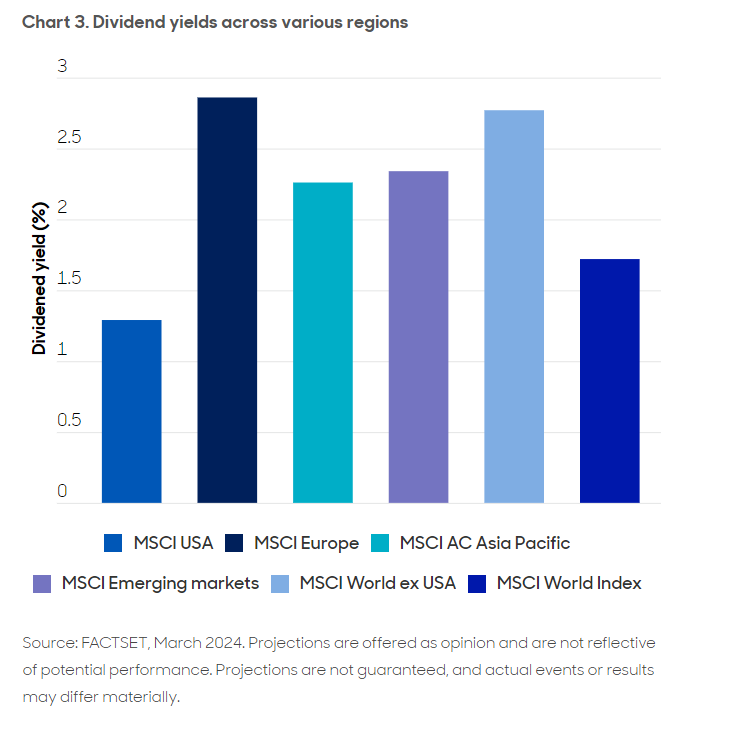

The following chart shows the dividend of various regions using the MSCI index. It shows European companies pay more than double the dividend yield of their U.S. peers. Even Emerging Markets have higher dividend yields than the U.S. The dividend culture in the US has eroded in the past few decades as the market has gravitated towards growth than income.

Click to enlarge

Source: Home bias blues? The case for international diversification, abrdn Investments

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard MSCI Emerging Markets ETF (VWO)

Disclosure: No positions