Recessions are generally negative for equity returns. During recessions, economic contraction leads to lower production and consumption leading to hurt sales for companies. Currently the US economy is holding up but nobody knows if it will slip into a recession later this year or early next year. As a consumption-based economy, the US consumer hasn’t slowed down spending.

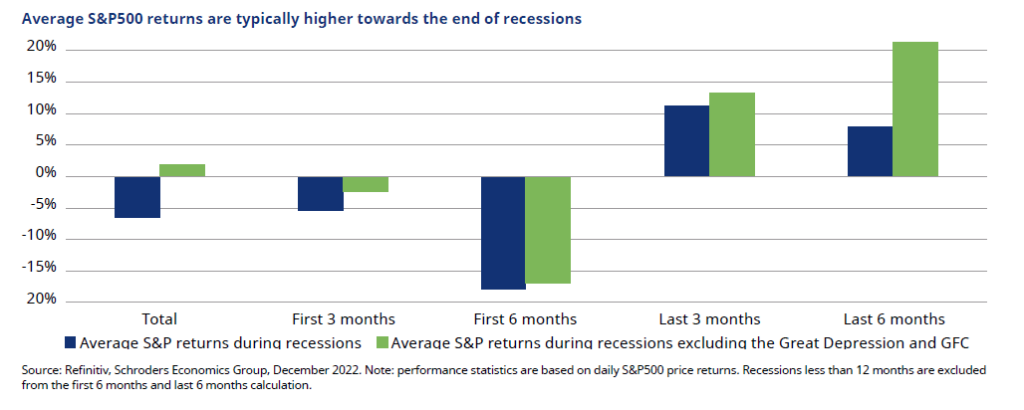

From an investor perspective, it is important to keep an eye on the direction of the economy. One report by Schroders showed that the S&P 500 generates a negative return during recessions. However in the late stages of a recession, the index yields a positive return as shown below:

Click to enlarge

Source: Ten key themes for 2023 and beyond, Schroders

For long-term investors recessions are bad. Since it is almost impossible to predict when a recession would end it is highly unlikely for anyone to make a profit with stocks while the economy is in recession. Most investors are likely to ride out the recession though they may not add new funds to the market.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF(VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

Disclosure: No position