For many years now Europe has been hit by one crisis after another.First came the fiscal crisis in Greece and then Portugal followed suit. Greece has been bailed out multiple times so far and is still struggling to recover. In general, the economies of the PIIGS countries have suffered greatly since the global financial crisis of 2008-2009. More recently the tiny island state of Cyprus triggered a new crisis and was bailed out. Up until the crisis, hardly any investor paid attention to, let alone worry about this island causing a global economic collapse.

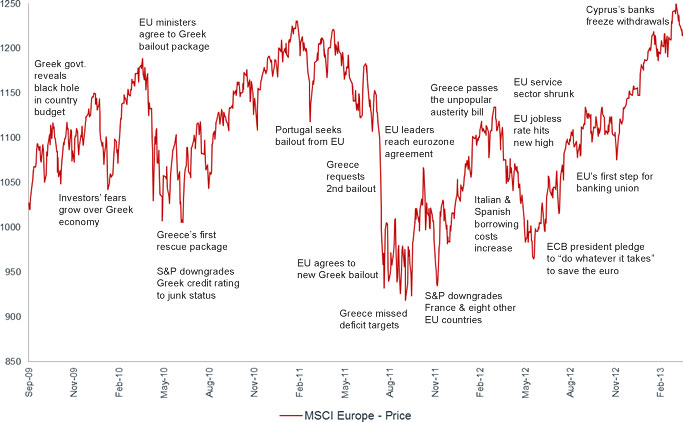

However despite the seemingly never-ending crises, European stocks have climbed higher in the past few years. The following shows the performance of the MSCI Euope index since September 2009. This index is a measure of the developed economies of Europe including the UK.

Click to enlarge

Source: European stocks rally despite the crisis, Fidelity Investments

Here is a excerpt from an article on European stocks by Michelle Gibley, Director of International Research, Schwab Center for Financial Research:

Europe’s economy is in recession, austerity is biting, politicians have repeatedly resisted measures to unite, and the Italian election is inconclusive—are there any reasons to invest in the eurozone? Actually, we think there are.

In spite of their many challenges, eurozone countries have begun to institute crucial reforms, their credit markets are thawing, and the Organisation for Economic Co-operation and Development (OECD) leading indicator and purchasing manager indexes suggest the eurozone economy has improved from the low hit in the fall. Corporate earnings and valuations remain relatively low, making it easier for companies to surpass investor expectations, and making stocks appear comparatively cheap. And in light of easing global uncertainty, we see fewer risks of a global slowdown harming the eurozone’s nascent improvement.

All of these factors contribute to our positive view on eurozone equities as a whole. Among individual countries, we prefer the stock markets in Germany and France. Select individual stocks of companies that are in cyclical sectors or have high foreign exposure or strong brands may also be worth a look.

Source: European Stock Outlook Upbeat Despite Challenges, Charles Schwab

As I have mentioned in previous posts one way to profit from the growth in emerging and other developed markets is to invest in European firms that have high exposure to overseas markets. Traditionally many European companies have maintained strong presence in foreign countries due to colonial ties. For example, many of the UK’s FTSE 100 firms generate a high portion of their revenues from emerging markets.

The YTD performance of select European equity indices are noted below:

CAC-40: 0.30%

FTSE 100: 6.6%

DAX: -2.0%

IBEX 35: -3.1%

The S&P 500 has outperformed the major European indices and is up 9.0% YTD.

Ten European stocks to consider are listed below with their current dividend yields:

1.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.11%

Sector: Food Products

Country: Switzerland

2.Company: Unilever PLC (UL)

Current Dividend Yield: 2.95%

Sector: Food Products

Country: UK

3.Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 5.07%

Sector: Telecom

Country: UK

4.Company: BASF SE (BASFY)

Current Dividend Yield: 3.84%

Sector: Chemicals

Country: Germany

5.Company: Banco Santander SA (SAN)

Current Dividend Yield: 8.83%

Sector: Banking

Country: Spain

6.Company: Total SA (TOT)

Current Dividend Yield: 5.43%

Sector: Oil, Gas & Consumable Fuels

Country:

7.Company: HSBC Holdings PLC (HBC)

Current Dividend Yield: 4.33%

Sector: Banking

Country: UK

8.Company: Heineken NV (HEINY)

Current Dividend Yield: 1.31%

Sector: Beverages

Country: The Netherlands

9.Company: ABB Ltd (ABB)

Current Dividend Yield: 3.35%

Sector: Electrical Equipment

Country: Switzerland

10.Company: British American Tobacco PLC(BTI)

Current Dividend Yield: 3.87%

Sector: Tobacco

Country: UK

Note: Dividend yields noted are as of April 19, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions

Disclosure: Long ABB, SAN