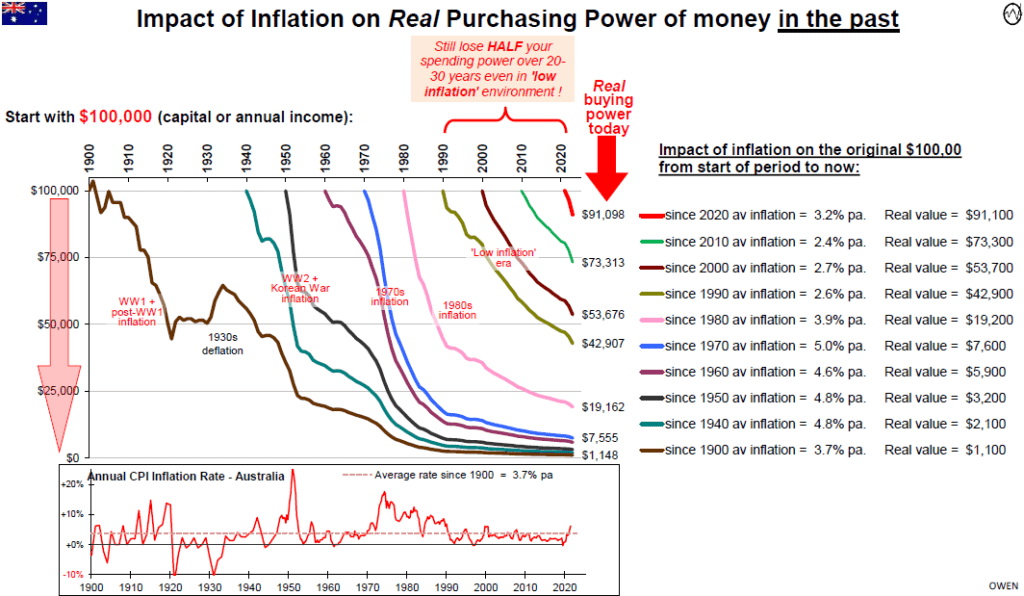

Inflation is bad because it reduces the real purchasing power of money. To put it another way, inflation makes the value of the dollar worth less. Central banks around the world are fighting hard to tame inflation. I recently came across an article that showed how inflation hurt the real purchasing power of the Australian dollar in the past. From the article:

The chart below shows the impact of inflation on $100,000 in assets or income over time in Australia, from different starting points. For example, $100,000 of assets or income in 1980 was a lot of money at that time (the median Sydney house price was just $69,000 in 1980) but $100,000 in 1980 dollars would have been whittled down to just $19,000 in today’s dollars if you didn’t protect it against inflation.

Another way of looking at it is if you had $100,000 in cash in 1980 and locked it in a safe then opened the safe today, you still have that same $100,000 but it would only buy $19,000 worth of today’s goods and services. (Or if you invested in term deposits in 1980 and you lived off the interest). Inflation over the years has eaten away 81% of its purchasing power.

The 1980 ‘real’ (i.e., after inflation) value line is the pink line starting from 1980 near the middle of the chart. We can see that the real purchasing power of $100,000 in 1980 decayed very quickly in the high inflation 1980s, but then the rate of value decay eased off (a less steep downward value decay curve) in recent decades. The section at the bottom of the chart shows the annual CPI inflation rate in Australia since 1990. Inflation was very high in the 1970s, then declined in the 1980s, and has been relatively ‘low’ in the 2000s and 2010s decades.

The problem is that, even in these so-called ‘low inflation’ years, inflation still had a serious detrimental impact on wealth and incomes. For example:

$100,000 starting in 1990 has been eaten away to a purchasing power of just $43,000 today.

$100,000 starting in 2000 has been eaten away to a purchasing power of just $54,000 today.

Even in the ultra-low inflation post-GFC years, $100,000 in 2010 has been eaten away to a purchasing power of just $73,000 today.

In the past two years alone, $100,000 at the start of 2020 has already lost 9% of its purchasing power to $91,000 today (the steep red value decay curve to the right of the chart).

The wealth-destroying effects of inflation never went away. Remember how central bankers dreamed about reviving inflation in the post-GFC years, and especially in 2020-21. We are all paying for that now!

Source: The wealth-destroying impact of inflation by Ashley Owen, Stanford Brown and The Lunar Group

Related: