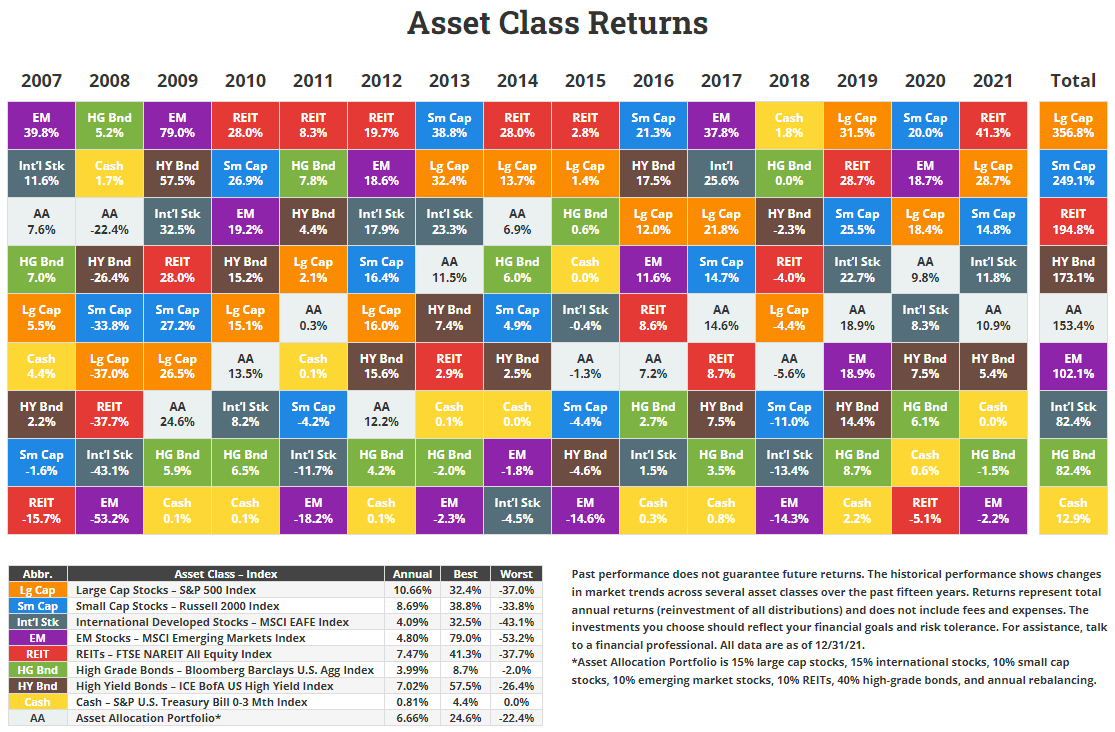

Diversification among asset classes is one of the key factors that investors ought to follow for success with investing in stocks. It is never a wise idea to put all money into one type of asset – whether it is growth stocks or value stocks or real estate or bonds. Assets of different types perform differently every year and it is impossible to predict which one will be top performer. The following chart illustrates this theory.

In 2021, REITs were the best performer with a total return of over 41%. This is much higher than the S&P 500’s 28.7%. Small caps had an average return. Emerging market equities were the worst with a loss of over 2%.

Click to enlarge

Source: Novel Investor

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Germany Index Fund (EWG)

- iShares MSCI Canada Index Fund (EWC)

- Vanguard Total Bond Market ETF (BND)

- iShares TIPS Bond ETF (TIP)

- iShares MSCI Emerging Markets ETF (EEM)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

Disclosure: No positions