Four different type of Santander bank ADRs trade on the New York Stock Exchange.In order to clarify any confusion when identifying the relevant ticker, here is a brief overview of the four ADRs:

1.Banco Santander SA (SAN):

Santander is the Spain-based multinational banking group with operations in Spain, the United Kingdom, Portugal, the Latin American countries and the United States. The ticker changed a while ago to SAN from STD. Currently the bank has a market capitalization over $73.0 billion and the share price closed at $7.13 today with the dividend yield at 11.35%. Due to high losses stemming from its exposure to the Spanish real estate market and the financial crisis, the stock fell heavily and reached a low of $4.87 in March 2009.

2. Banco Santander-Chile (BSAC):

This bank is one of the largest private sector banks in Chile. Today the stock closed at $26.92 and the current dividend yield is 4.18%. Unlike SAN, Santander-Chile has a smaller market capitalization of over $12.0 billion and is a better long-term performer than the Spanish banking group. The former ticker for BSAC was SAN.

3. Banco Santander Brasil SA (BSBR):

Santander Brazil is one of the large full-service banks in Brazil. The ADR was listed on the NYSE in October 2009 . The current dividend yield is 3.63% and the market capitalization is over $26.0 billion. Though the stock reached a peak of over $15 in late 2010, it closed at $6.90 today.

4.Santander Mexico Financial Group, S.A.B. de C.V (BSMX):

Founded in 1991, Mexico City, Mexico-based Santander Mexico Financial Group offers banking services primarily in Mexico. The ADR became effective on October 1, 2012. The bank has a market capitalization of over $9.0 billion and the stock pays no dividends. At the end of September Santander Mexico served 9.7 million customers.

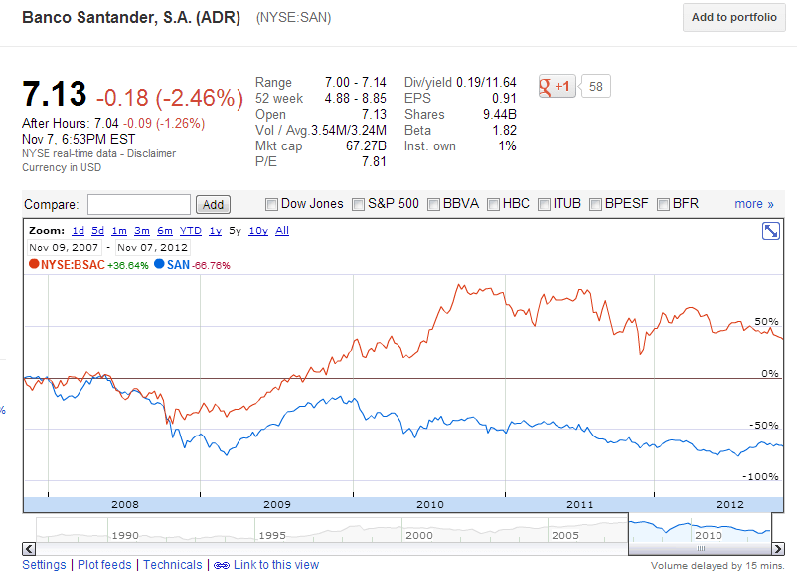

A comparison of 5-Year performance of Banco Santander of Spain and Santander-Chile:

Click to enlarge

Source: Google Finance

The difference is returns is due to the strength of the Chilean economy and the banking system compared to the poor performance of the Spanish economy in the past few years.

Note: Dividend yields and other data noted are of Nov 7, 2012

Disclosure: Long SAN