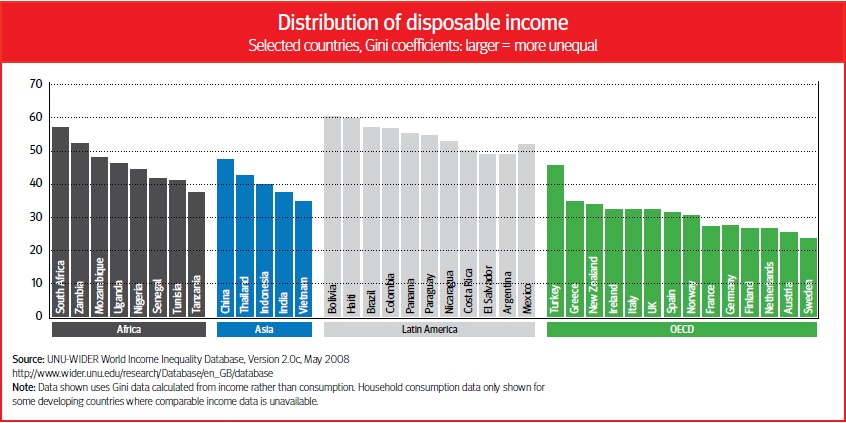

The Gini Coefficient measures inequality of income or wealth between countries. The higher the ratio the higher the inequality.Countries such as Brazil, Russia, China, India, USA, etc. have high Gini coefficients due to the extreme disparity in wealth and income between the elite and the rest of the population.

The following chart shows the Gini coefficients for select group of countries based on disposable income:

Click to enlarge

Source: How tax can reduce inequality, OECD Observer

In Asia, China is more unequal than India. Among the OECD countries, Turkey is more unequal than Sweden which is not surprising.

From the OECD article:

A rising tide may not now lift all boats, to misquote US President Kennedy’s original analogy made in 1963 linking economic growth to prosperity for all. Can governments maintain the social cohesion needed for sustainable, long-term growth? Supporting an equitable income distribution remains one of the key goals of fiscal (and tax) policy.

The rapid growth of emerging economies in the past decade or so has lifted hundreds of millions of people out of absolute poverty and reduced income disparities across the world as a whole. At the same time, until the financial and economic crisis of 2008, most other economies were expanding too. However, within the OECD and emerging economies not all regions or people benefitted equally from the growth years. On the contrary, the distribution of income tended to become more unequal.