Gasoline prices at the pump tend to go up and down often in the U.S. Unlike other developed countries, the volatility of gas prices in the U.S. is high.

Brent crude closed at $112.39 on Friday and gasoline prices stood at an average of $3.79 per gallon nationwide. From just under $3.50 per gallon last September the price has jumped to reach almost $4.00 now. In the same period, the price of crude oil has also increased. Since gas prices at the pump are tied to crude oil prices, as crude oil prices rise gas prices also rise. According to a research report by JP Morgan Asset Management, “the cumulative effect of a change in the price of crude oil in the price of gasoline at the pump is much larger in the U.S. than in other developed countries. Over the course of a year, about 80% of the original oil price shock is passed through to the pump price in the U.S., compared to 40% or less in the U.K., Germany and Japan.”

Click to enlarge  Source: Inflation: In the eye of the beholder, JP Morgan Asset Management

Source: Inflation: In the eye of the beholder, JP Morgan Asset Management

Why do gasoline prices are so volatile compared to other countries?

The answer to the above question lies in taxes. It is no secret that the U.S. has the one lowest taxes on gasoline in the world. If taxes are higher like other countries, then most the price at the pump will be fixed thereby reducing high volatility.The above shows that U.S. gasoline taxes are below 20% of the purchase price. This is less than half of what consumers pay as taxes in the UK, Japan and Germany. Hence gasoline prices in the U.S. remain volatile than countries with higher gasoline taxes.

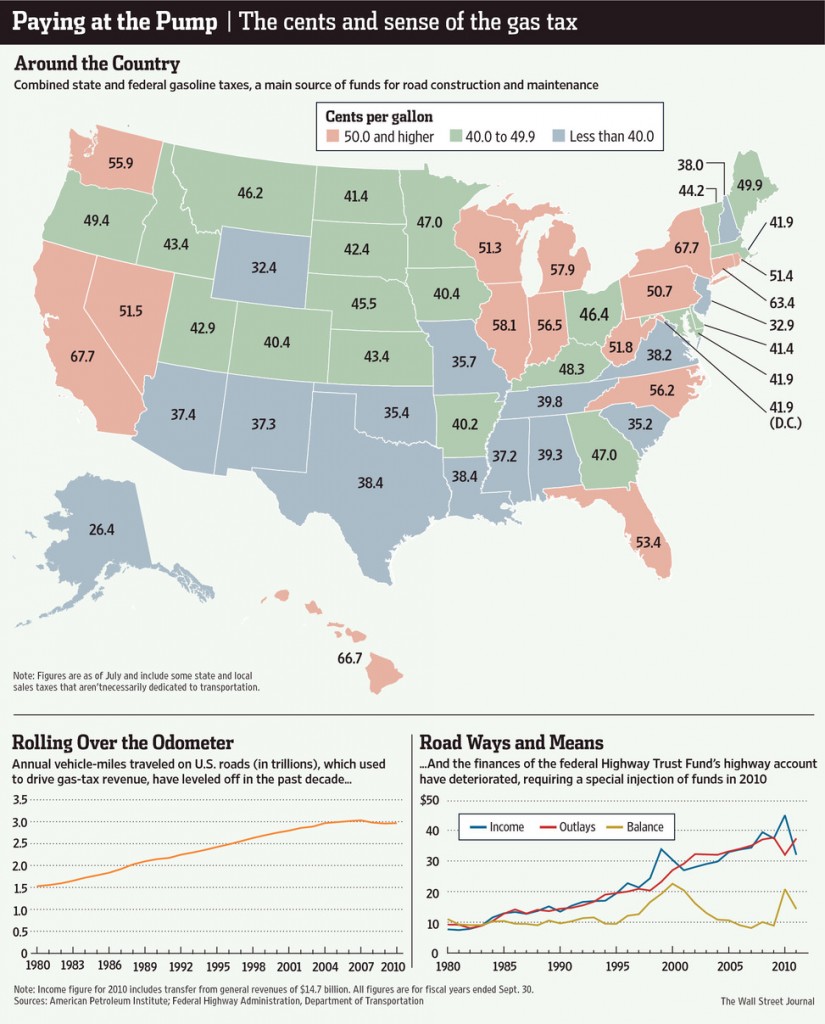

The Wall Street Journal published an article discussing the issue of gasoline taxes in this country. From the article “The Gas Tax Is Running Low. But What Should Replace It?“:

The gasoline tax is running on fumes.

For decades, the excise tax on gasoline and diesel fuel has been the main source of funds for building and maintaining the nation’s roadways. It has paid for most of the four million road miles currently in service.

.

Click to enlarge

But now there is agreement across the political spectrum that the gas tax is broken and needs to be replaced, or at least overhauled. The problem is twofold: First, the tax has failed to keep up with the rising cost of highway construction and repair. And second, improved fuel economy and the rise of hybrid and electric vehicles means that more driving won’t be matched by higher gasoline sales, and that how much people pay for the roads won’t necessarily reflect how much they use them.

The gasoline taxes consumers pay at the pump is shared between the individual states and the Federal government. The Federal tax at 18.4 cents for gasoline and 24.4 cents for diesel has not changed since 1993, according to the journal article. The chart above shows that the combined state and Federal taxes on gasoline at 50 cents or more per gallon is in effect in only some of the U.S. states. For a country that is heavily dependent on road transportation for the majority of the population policy makers have miserably failed with regards to gasoline taxes. As in most other issues, consumers pay the price for this failure due to the constant volatility of gas prices at the pump.

Related ETFs:

United States Oil Fund (USO)

United States Gasoline Fund (UGA)

Disclosure: No Positions

If gasoline tax helps fix and maintain roads then why are they crumbling, bridges falling apart and pot holes from last winter never filled? This tax is supposed to go to that but is it really?

Shore thing

Thats a good point. I did not think about that.I am sure some states are mis-allocating the funds to other things. Let me do some research on this issue and write an article in the future.

Thanks for the comment.