The four major Australian banks – Commonwealth Bank of Australia, Westpac, Australia and New Zealand Banking Group and National Australia Bank – have had a tough past few years. With most of the troubles over, some of these stocks are in recovery mode from the hard and deep slump. Let’s take a quick look at the performance so far this year and in the past five years.

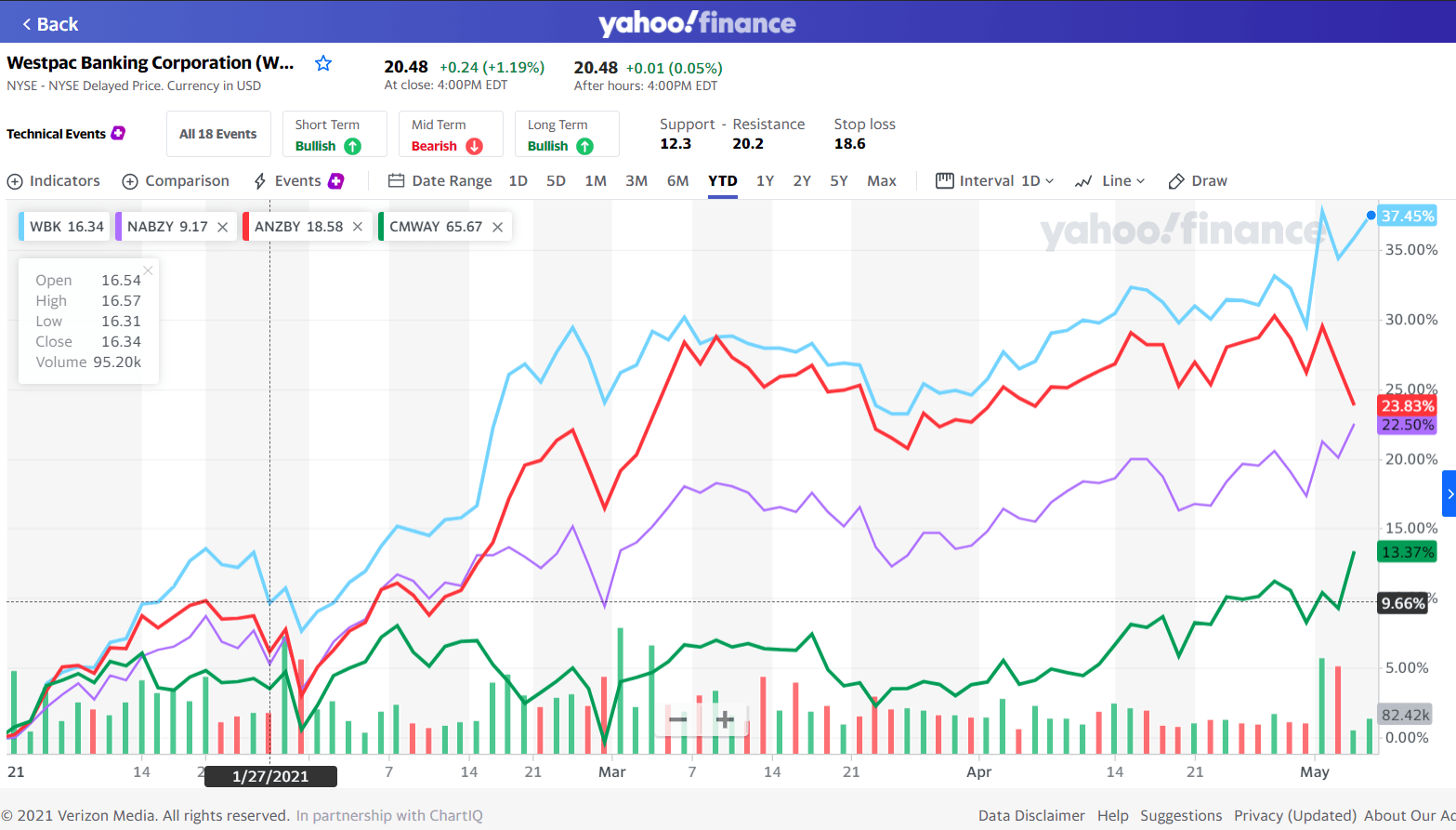

Australian bank stocks’ price return year-to-date:

Click to enlarge

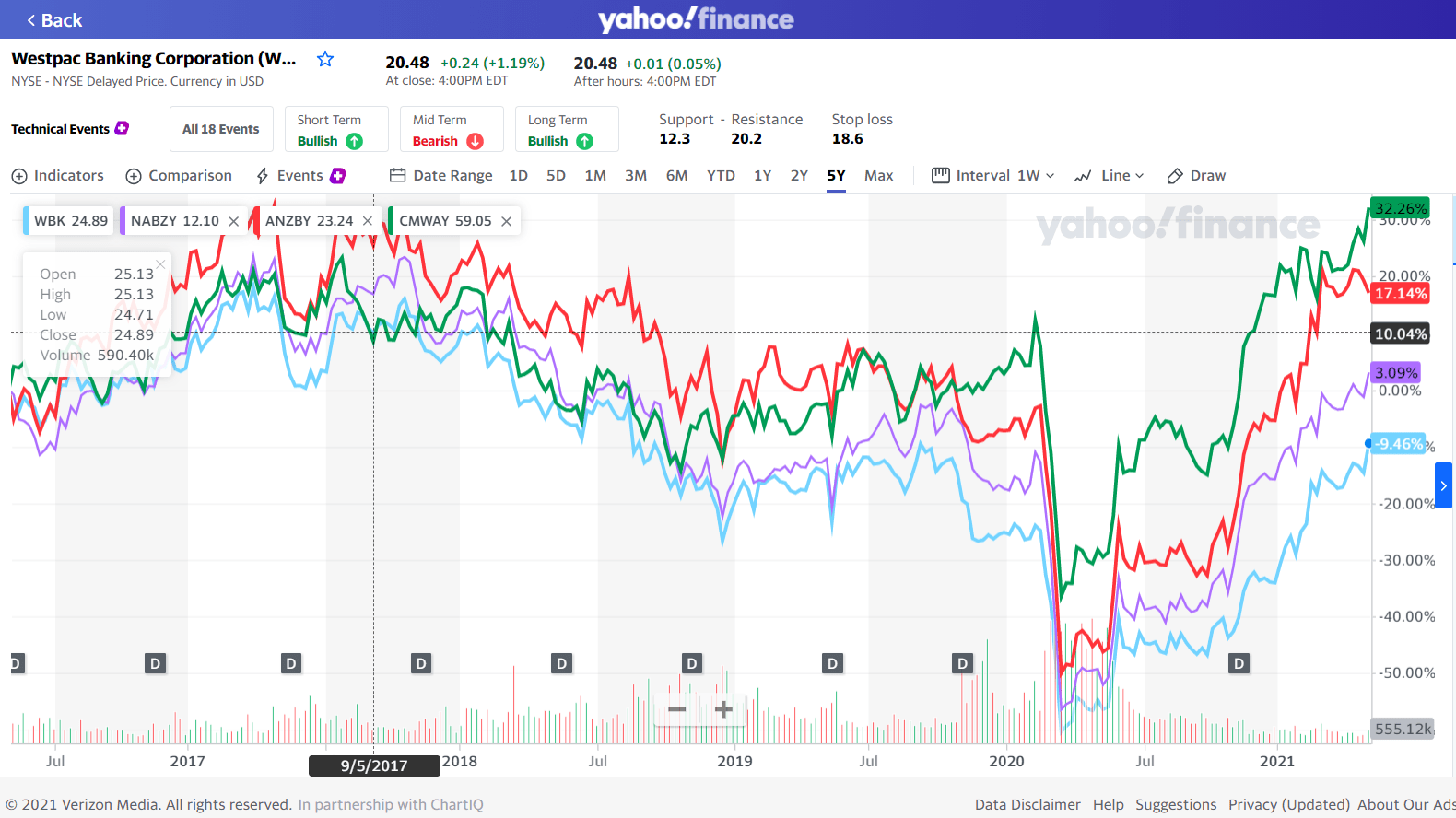

Australian bank stocks’ price return in past 5 years:

Click to enlarge

Source: Yahoo Finance

Westpac was the worst performer in the past 5 years. However this year it has soared with a return of over 37% so far.

The current dividend yields and the tickers on the US market of the major Aussie banks are listed below:

1.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 3.38%

2.Company: Australia and New Zealand Banking Group Ltd (ANZBY)

Current Dividend Yield: 1.96%

3.Company: National Australia Bank Ltd (NABZY)

Current Dividend Yield: 2.03%

4.Company:Commonwealth Bank of Australia (CMWAY)

Current Dividend Yield: 4.25%

Note: Dividend yields noted above are as of May 7, 2021. Data is known to be accurate from sources used. Please use your own due diligence before making any investment decisions.

Disclosure: Long NABZY and WBK