Diversification is a simple and easy way to reduce risk. While spreading one’s funds across various asset classes is wise it is also important to avoid investing all or most the funds in one’s home country companies. Most investors including those in the US are affected by what’s called the “Home Bias”. According to a Vanguard study, just over 80% of American investors’ portfolios are invested in US companies. Recently I came across an interesting article on the importance of diversification. Below is an excerpt from the piece:

It Might be Time to Take a Fresh Look at Your Portfolio

Given the incredible run in the U.S. stock market over the past 12 years, now may be just the time to consider how diversified your portfolio truly is. Taking a fresh look at international developed and emerging markets may be just what your portfolio needs.

Recent Performance Advantage of the U.S. Stock Market

Some may point to the performance advantage the U.S. stock market has experienced over the past several years as justification for this bias. And it is true that U.S. companies have outperformed more recently. In fact, the U.S. market outperformed an index of international developed markets 9 out of 10 years from 2011 to 2020; however, during the 10 years prior (2001 to 2010), the U.S. outperformed in only 3 years. And if we take a long-run view over the past 50 years, the U.S. has outperformed exactly half of the time. Thus, from a performance perspective, history suggests a need for global diversification as well. But this performance argument is potentially flawed regardless. Again, diversification is more about ensuring you have an optimal investment portfolio. By not taking advantage of international diversification, investors are not optimally controlling for the risk within their portfolios.

The U.S. Stock Market has become Top-Heavy

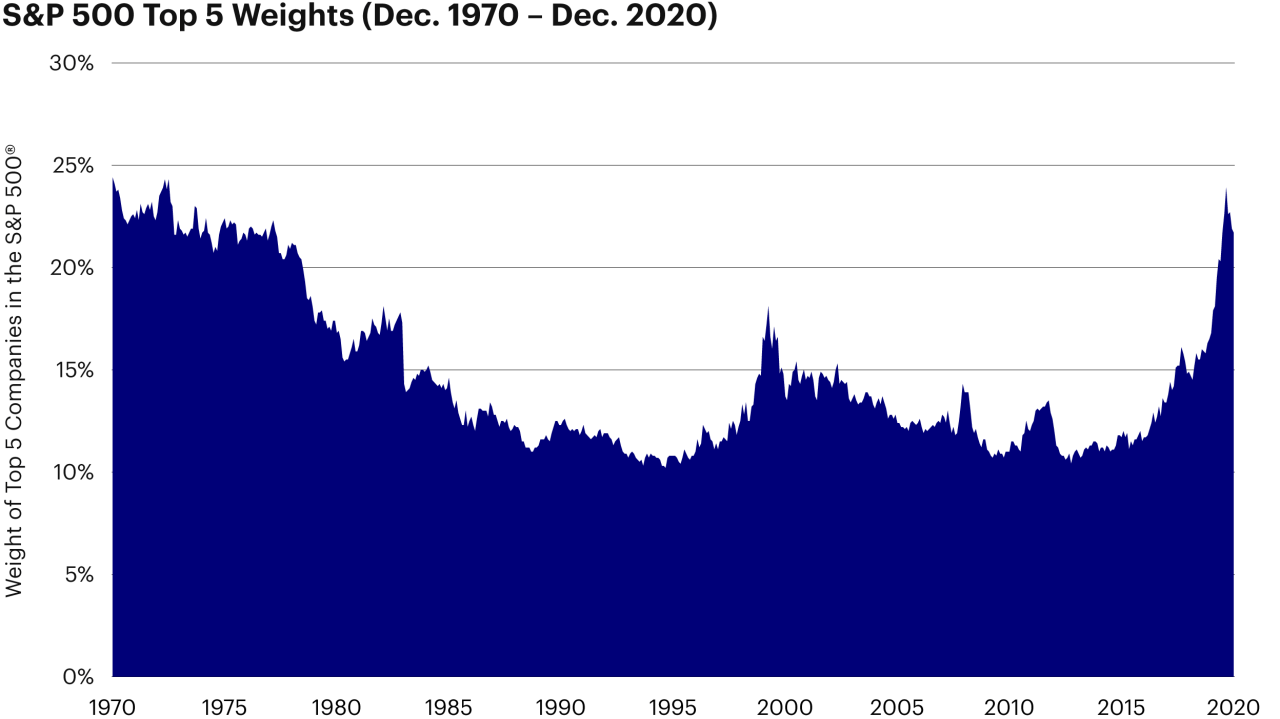

A more recent trend in U.S. markets may highlight further need for international diversification. Due to the outsized performance of the “FAANG” stocks (Facebook, Apple, Amazon, Netflix, and Google) in recent years, the U.S. stock market is historically top-heavy. This suggests that an investment portfolio dominated by U.S. stocks will be overly sensitive to a handful of large U.S. technology companies. A globally diverse portfolio can provide the necessary diversification to ease this sensitivity.

Source: Just How Diversified is your Portfolio?, Scottsdale Wealth Planning

Indeed the S&P 500 is heavily concentrated as shown in the following chart:

Source: Take the concentration out of the S&P 500 with RSP, Invesco

From the above article:

As a market capitalization-weighted index, the S&P 500 typically has a heavy concentration in a few names, and as its top five holdings as of Dec. 14, 2020 — Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG/GOOGL), and Facebook (FB) —have zoomed ever higher in 2020, they have come to dominate the Index’s performance. While the S&P 500 ostensibly measures 500 companies, the five largest companies have grown to account for nearly 22.0%3 of its weighting, a significant rise from 16.8% at the end of 2019.

Note: As the S&P 500 has grown ever more top-heavy, many investors in products tied to the Index have found themselves facing historic levels of concentration risk, the likes of which passive investors have not seen since 1970 — half a century ago3

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions