This week President Obama reduce the corporate tax rate from 35% to 28% in order to stimulate economic growth. Naturally this has kicked off a political firestorm as some consider this to a classic political ploy in an election year while others strongly support the plan.

From an article in the New York Times:

WASHINGTON — President Obama will ask Congress to scrub the corporate tax code of dozens of loopholes and subsidies to reduce the top rate to 28 percent, down from 35 percent, while giving preferences to manufacturers that would set their maximum effective rate at 25 percent, a senior administration official said on Tuesday.

Mr. Obama also would establish a minimum tax on multinational corporations’ foreign earnings, the official said, to discourage “accounting games to shift profits abroad” or actual relocation of production overseas.

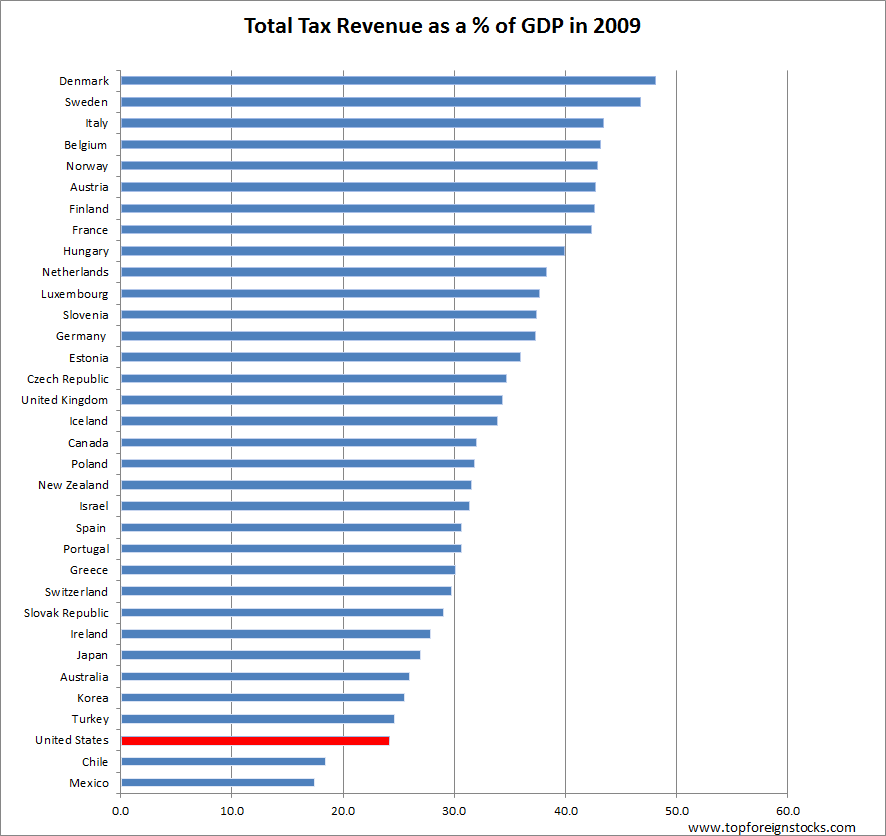

While reduction of any form of taxes would be welcomed by the public, in general, should the US reduce taxes? One way to answer this question is to look at a country’s total tax revenues as a percentage of a its GDP. Based on this measure for 2009, the U.S. has already one of the lowest figures among the OECD countries and hence corporate taxes need not be reduced. Skyrocketing government expenditures with low tax revenues also leads to higher deficits. It must be noted that most of the taxes collected by the U.S. is from individuals and not corporations. Over the past few decades the U.S. has slowly shifted the burden of taxes from corporations to individuals with some companies paying no taxes while earning billions in profits.

Comparison of Total Tax Revenues as a Percentage of GDP among OECD countries:

Click to enlarge

The U.S. has the third lowest tax revenues at 24.1% of the GDP (based on 2009 data) with Mexico having the lowest among the developed countries.

Source: OECD