As 2011, dubbed as the ‘Year to Forget’, is coming to end soon some investors are wondering if bank stocks are worth getting into now. Since the credit crisis most bank stocks have been decimated and some of the banks have completely disappeared due to forced takeovers, mergers or failures. However despite all the calamity in the industry in the past few years, U.S. banks are now in a better position compared to their European counterparts. This is because unlike European banks, U.S. banks were quick to got rid of bad assets from their balance sheets and strengthened their financial position by raising fresh capital. However despite this positive development, many questions still remain about the wisdom of investing in their stocks.

One of the reasons for investors’ worry about bank stocks is that they have become too volatile relative to the overall market and other sectors. The daily drama with the European debt crisis that primarily impacts European banks and large US banks is not helping the situation for the entire US banking sector.

In terms of equity performance of banks, the KBW Bank Index is down 23.5% while the S&P 500 is flat YTD . Individual banks such as Bank of America(BAC), Citibank (C), JPMorgan Chase (JPM) are also down by double digit percentages YTD with Bank of America off over 58%.

Recently I came across an interesting article on the volatility of bank stock prices. From The Wall Street Journal article published last month:

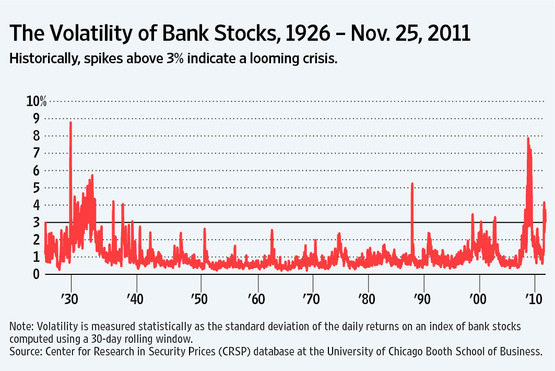

The volatility of bank stock prices from one day to the next depends on investor perceptions of the riskiness of the assets held by banks. In tranquil times, when investors feel that bank portfolios are reasonably safe and not excessively leveraged, daily volatility is low. When investors are uncertain about the soundness of bank balance sheets and about the adequacy of bank capital, then daily volatility rises in bank stock prices to double or triple their normal levels.

When uncertainty turns to panic, as it did in 1929-33 and again in 2008-09, the volatility in the daily movements of bank stock prices can shoot up to seven or eight times their normal levels. When this occurs, the damage radiates quickly from the banks to the broader economy.

These dynamics are illustrated in the nearby chart, which shows the volatility of daily movements in an index of all publicly traded bank stocks from 1926 to the present. In normal times, volatility hovers below 1%, occasionally rising as high as 2%, and rarely rising above 3% unless a serious crisis is at hand.

Source: The Rising Fear in Bank Stock Prices, The Wall Street Journal

The global financial crisis of 2008 pushed the volatility of bank stocks to levels that were last observed during The Great Depression. However in spite of improvement in the financial strength of the industry volatility still remains high.

So should investors completely avoid bank stocks now?

The answer is absolutely not. In my opinion, investors must have a small exposure to the banking sector. As banks are the pillars of any economy and the US banking system has been stabilized in recent years, it is highly unlikely the sector will face another big crash similar to the one it went through during the global financial crisis.

Since hundreds of bank stocks trade on the market, investors looking to add some bank stocks can consider “The Top 150 Banks” list published by the Bank Director magazine last quarter. The top five banks in the list, which was compiled based on many factors, were State bank Financial Corp. (STBZ), First Financial Bankshares Inc(FFIN), City Holding Company(CHCO), First Republic Bank(FRC) and Republic Bancorp, Inc(RBCAA). The full list of 150 companies can be found here.

Disclosure: No positions