The European Union has sought China for help with solving the current debt crisis. The Europeans are asking the Chinese to invest in a fund setup as part of the European Financial Stability Facility (EFSF) program. Negotiations are underway between the two parties as the Chinese are keen to take advantage of the opportunity but want to make sure that they are getting a better deal on their investments.

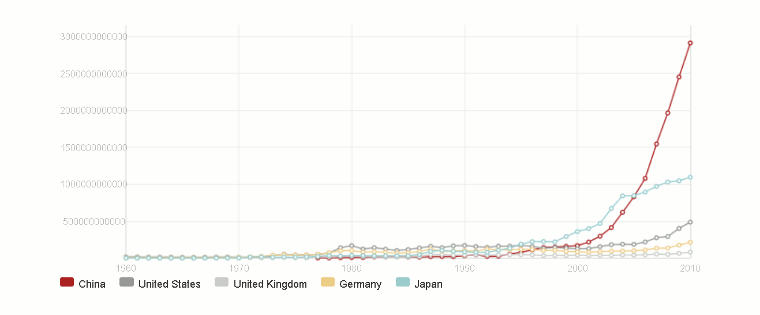

The following graphic shows why China is in a better position to lend compared with select developed countries:

Click to enlarge

Note: Please excuse the quality of the chart.

Source: Chart of the Day: why Europe really, really needs China, CityWire, UK

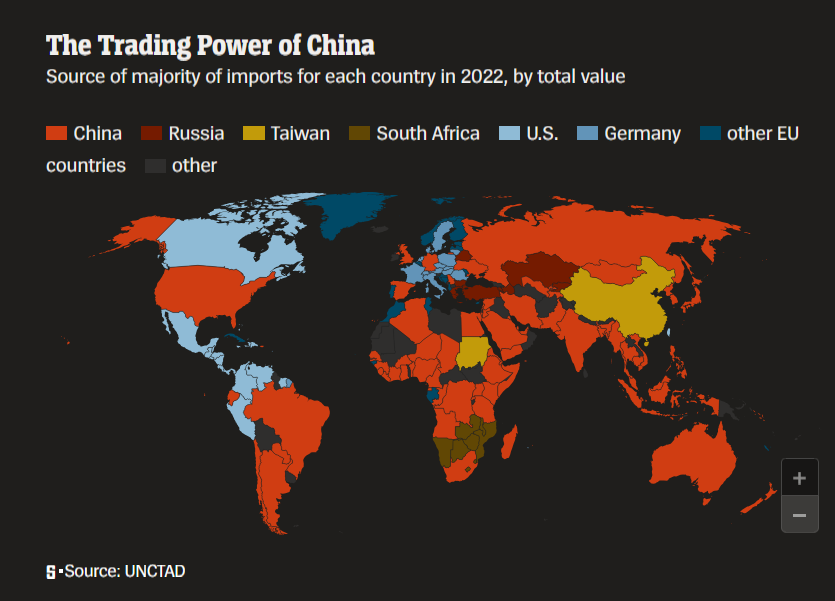

It is not just the EU that is currently dependent on China to solve fiscal issues. As the world’s largest debtor nation, the U.S. also depends heavily on China to sell its debt. China remains the largest foreign holder of U.S. debt with total holdings exceeding $1.2 Trillion.

The economies of the developed world remain in contraction mode now and are projected to under-perform emerging economies over the next few years. Hence debt crises and other issues can occur again in the developed world. As a result it is safe to say that the West needs China more than China needs the West.