The Indian economy is in a severe slowdown with the latest GDP falling to just 5%, the lowest in five years. Unlike developed countries’ GDP rate, 5% is considered a low rate for India since it is an emerging market and has been growing at a much higher rate like 7% or more. With the economy stagnant, job growth is almost zero. Many industries are suffering and the highly important auto sector saw the decline in new auto sales for the 10th month in a row in August. Auto sales have crashed by 41% the highest decline in the past two decades.

To arrest the further crisis in the economy, past Thursday the corporate tax rate was slashed from 30% to 22%. This dramatic action should help companies as they stand to save in taxes paid and more importantly this policy change is expected to spur investments leading to economic growth again.

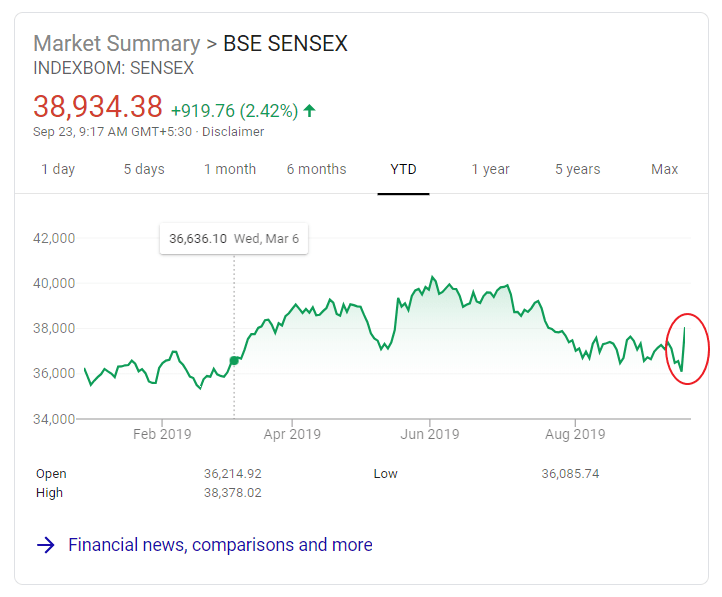

Indian stocks as represented by the benchmark Sensex soared by 5.3% on Friday. It remains to be seen if this tax cut leads to additional gains in equities in the coming days.

The following chart shows the YTD return of Sensex Index:

Click to enlarge

Source: Google Finance

A handful of Indian companies trade on the US markets. The complete list of Indian ADRs can be found here.