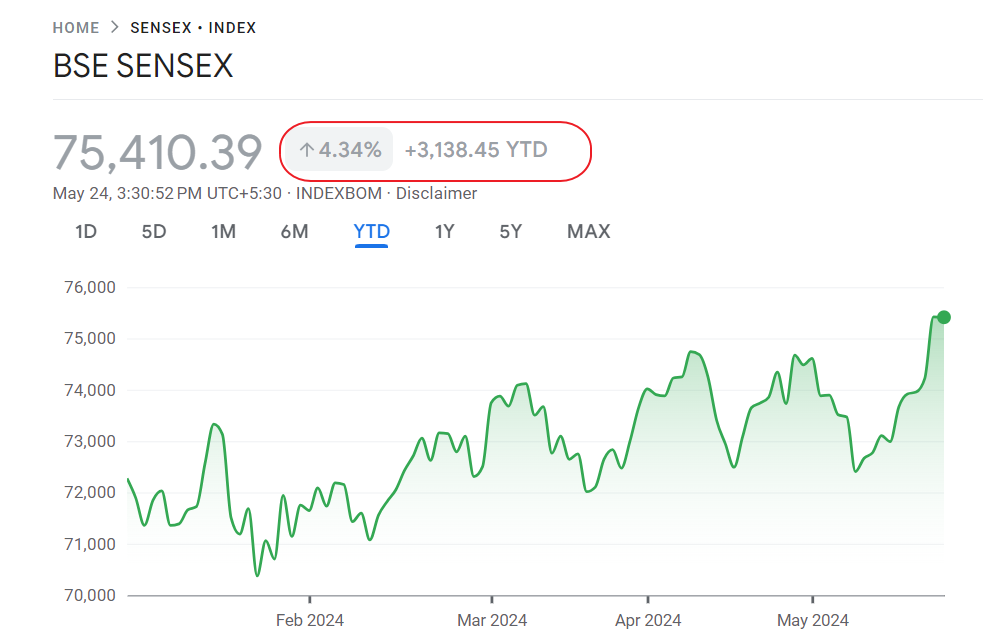

The S&P BSE SENSEX Index of the Indian equity market soared recently after the re-election of the Prime Minister Modi. The index is up just over 10% year-to-date.

Currently the index is trading in the 39,800 range within a striking distance of the 52-week high at 40,312. It remains to be seen if it can surpass the 52-week high and hit a new record.

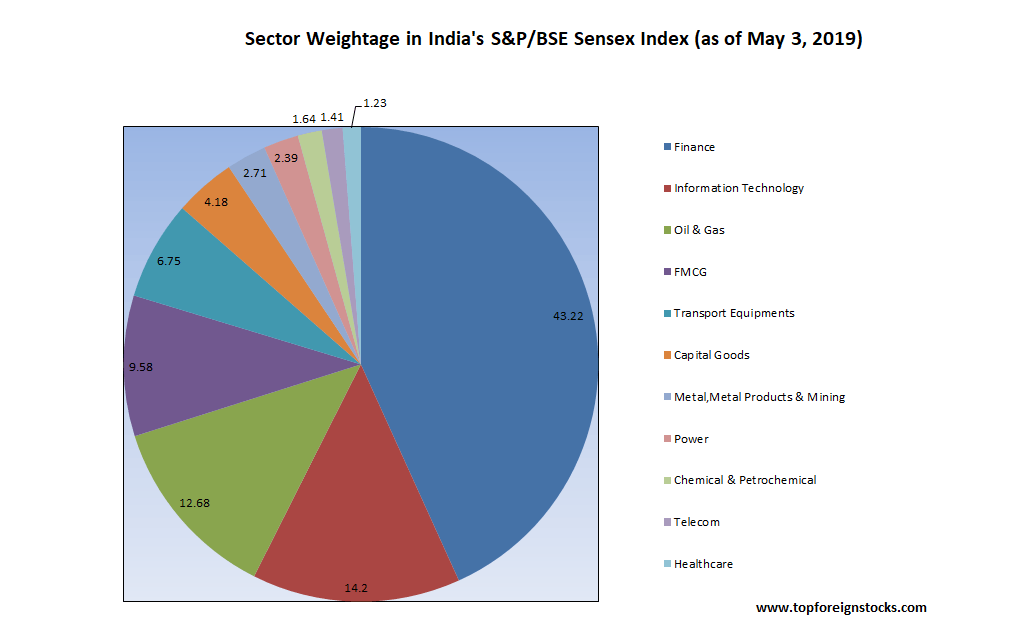

Similar to other emerging market indices, the Indian benchmark is highly concentrated with a few major sectors dominating the market. In most emerging markets, the banking/financial sector is the biggest sector in the benchmark. The financial sector is the largest sector in the Sensex also. This sector accounts for just over 43% of the index.

The next four major sectors in the Sensex are IT, Oil & Gas, Fast-Moving Consumer Goods(FMCG) and transport equipments. The extremely high allocation to finance in the index is both a huge risk and opportunity.

The chart below shows the composition of the S&P BSE Sensex Index:

Click to enlarge

Source: BSE

Two of the major private sector banks trading in the US markets are HDFC Bank Ltd (HDB) and ICICI Bank Ltd(IBN).

Related ETFs:

Disclosure: No Positions