Intro:

On Saturday, January 5, 2008, I wrote an article titled “India,China stock market bubbles !! Time for a (bubble) bath?“. The gist of that article was:

On Saturday, January 5, 2008, I wrote an article titled “India,China stock market bubbles !! Time for a (bubble) bath?“. The gist of that article was:

“Before you jump with both feet into these red hot markets, read this post first.

The markets in these two countries are a bubble waiting to burst at any time. Both countries are experiencing heavy Foreign Direct Investments (FDI) which is fueling all kinds of hype – ranging from infrastructure construction to real estate investments. The P/E ratios of stocks in these countries are now multiple times that of the developed markets.”

Again on Saturday, February 2, 2008 in my 2nd article on India titled “India – Will economic growth continue ??? “, I wrote:

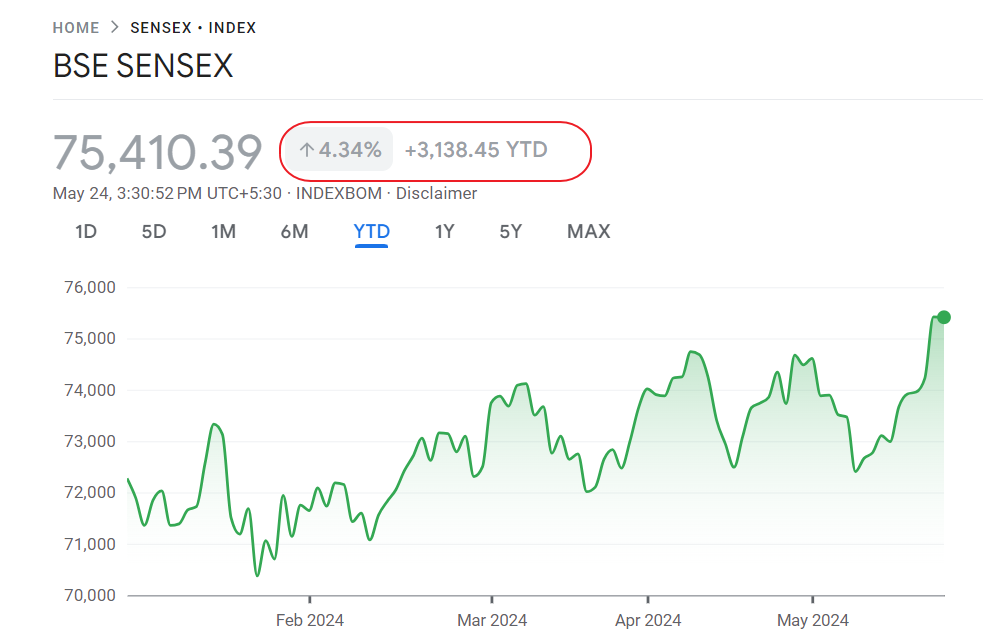

“As discussed in my previous article, the Indian stock market was hot and is cooling off now. It has fallen from over 21K to 17K+ with a 20% decline.

…. Only time will tell how these ETFs perform considering the local market is shaky there.”

Update:

Well folks the market there fell even in the past few weeks. From a high of about 21K the main Index Sensex closed at 15975.5.This represents a fall of nearly 23% from the peak.

Bombay Sensex Chart

Courtesy – www.TheHinduBusinessLine.com

As the above chart shows, the past year return on the index is only 27% which is well below the 40% that the Indian market returned over the past few years. The hard hit sectors so far are IT,Realty, Infrastructure and Banking.

Why did the red-hot Indian market crash?

Obviously there are many reasons.Some of them are listed below:

1. Sky-high stock valuations for an emerging country

2. Excessive speculation in the market on some stocks like we had here during the dot con days on the 90s.

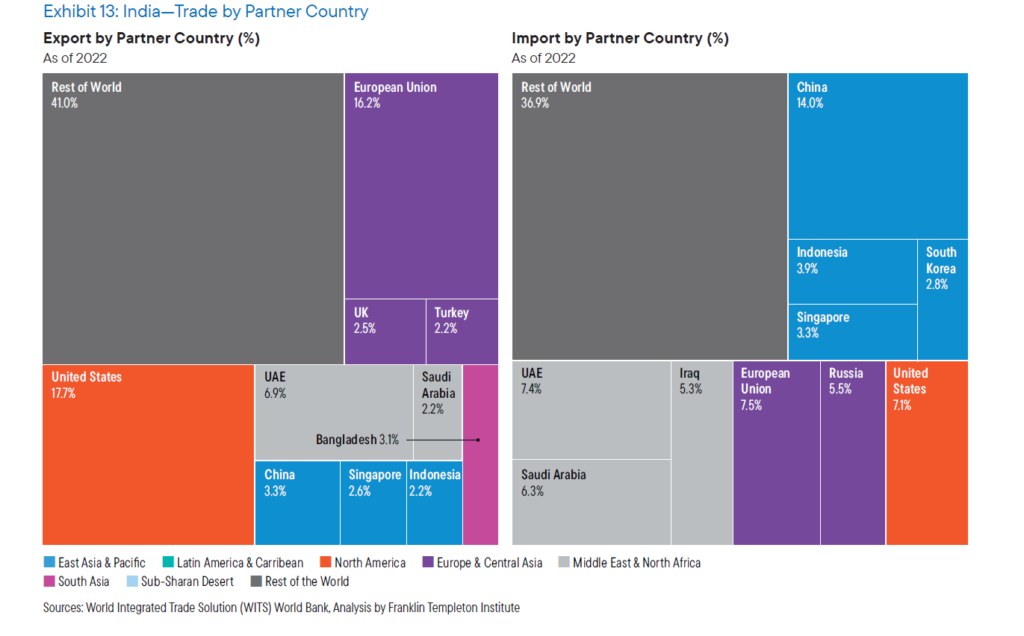

3. Foreign Capital – Foreign Portfolio Investment into India is huge nowadays. Billions of dollars that have been pumped in by overseas investors are bring pulled out. This has a direct effect on those bubbly share prices.

4. Effect of Recession in the US and the slowdown of global economies

5. Populist Government Policies – Last week, when the government launched the budget for 2008, it waived some $15B in loans owed by farmers to banks. Apparently this was done to please millions of farmers for their votes in the election due next year. The reason given by the government is that this will help farmers to wipe out their debt and start fresh. In the past few years there were thousands of suicides committed by farmers unable to make payments on their loans.

This $15B loan waiver is a huge hit to banks since they are already suffering the effects of the global credit crisis, slowdown in real sector estate etc. Also this sets a bad precedent on the part of the government since some of these farmers are very rich and will now go scott-free.

So should I invest in India now?

That depends.But it may be better not to invest a big chunk of portfolio there whether it is by buying ADR stocks or thru ETFs. Another idea might be to wait and watch how this plays out in the next 3 months or so.

Two new India ETFs were launched in February:

1. The WisdomTree India Earnings Fund – (EPI)

2. PowerShares India Portfolio (PIN)

PIN started out big, but is now over 20% from the peak.It may be bad timing for the launch of these ETFs since the domestic market in India is crashing.

Other India ADRs like WIT, SIFY, TTM, etc are all down a lot from their 52-week high as well.