A review about 3 Australian bank stocks that pay great dividends and have above average dividend growth rates.In the current market conditions nobody knows exactly where financials and in general the markets are heading. A simple and effective strategy now maybe to nibble a few foreign stocks that pay high dividends. One group that fits this idea are the Australian bank stocks.

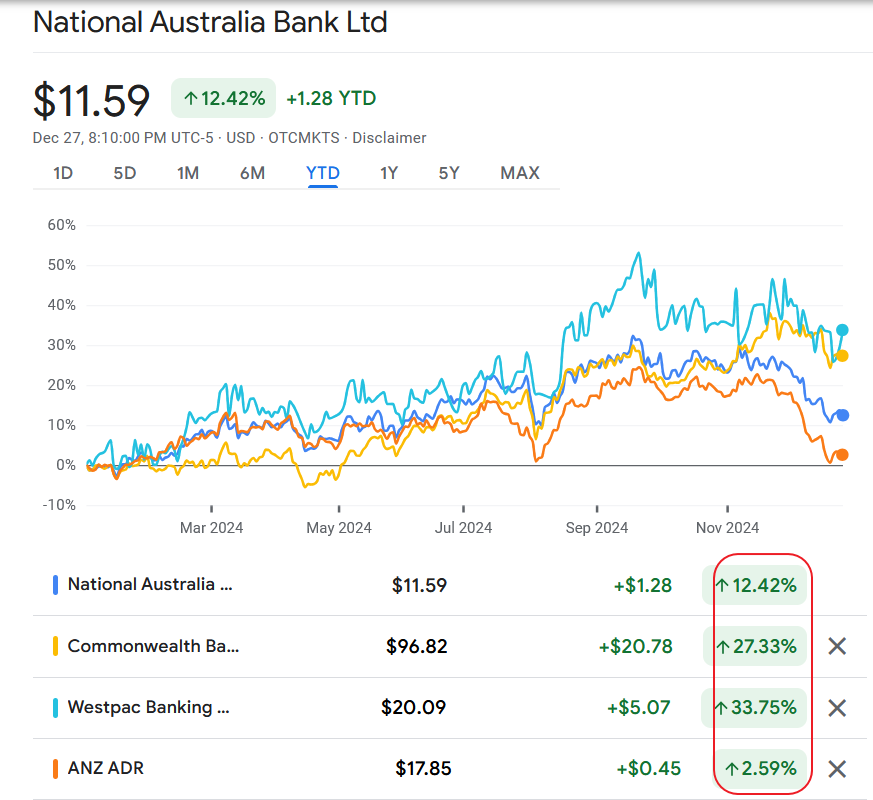

All these 3 banks trade as ADRs in the US but only one (WBK) is listed in the New York Stock Exchange. The other 2 trade in the OTC markets. Here is a brief overview of these bank stocks:

1.Company Name: Westpac Banking Corp

Ticker: WBK

Country: Australia

Dividend Yield : 6.85%

Annual Dividend Growth for past 5-years: 13.35%

2.Company Name: National Australia Bank Ltd

Ticker: NABZY

Country: Australia

Dividend Yield : 11.32%

Annual Dividend Growth for past 5-years: 4.35%

3.Company Name: Australia & New Zealand Banking Grp Ltd

Ticker: ANZBY

Country: Australia

Dividend Yield : 9.08%

Annual Dividend Growth for past 5-years: 11.36%

Just like Canada,Brazil,Russia,etc. Australia is also a commodity-driven economy. So any volatility in that sector will affect Aussie stocks heavily. However compared to mining stocks, banks may not be battered that much. Besides Aussie banks have high exposure to New Zealand and many other Asian markets and nearby Pacific islands.