Sydney Opera House

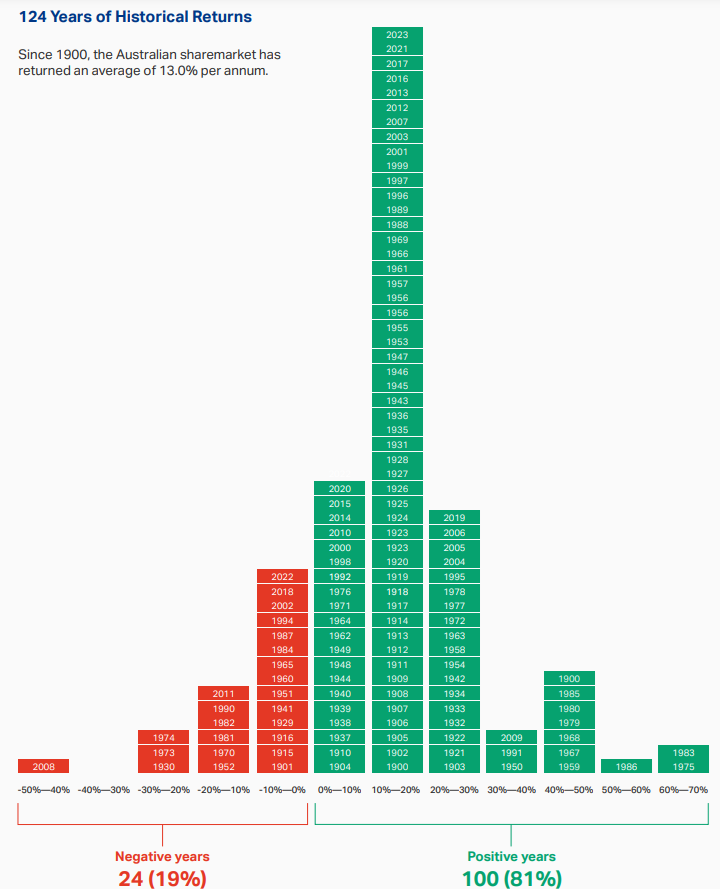

The Australian Stock Market Index,”ALL ORDINARIES INDEX” has crashed in the past few weeks in-line with other markets of the world. Year-to-date “Bank of New York Mellon Australia ADR Index”, which tracks the Australian ADRs listed in the US, is down 54.94%.

1-Year Chart of Australian All Ordinaries Index

On the currency front, the Aussie Dollar has fallen a whopping 37% against the US $ since reaching a peak of $0.9849 to the US$ about 3 months ago.London’s Financial Times calls the Australian Dollar the “whipping boy” of foreign exchange markets (Source:World gives Aussie dollar a walloping).

From a article titled “When will the Australian sharemarket recover?” by Nicolette Rubinsztein, here is a table of the major downturns in Australia since 1987:

Against the backdrop of all the above events,US investors are wondering whether now is the good time to pick up some Aussie stocks available here as ADRs. We do not know when the market will recover worldwide. Despite being a surplus country Australia got hit pretty bad just like all other countries in this credit crunch. However there are some high quality dividend yielding stocks that will survive this downturn and come back strong when the dust settles.

The following are six Australian stocks that have excellent dividend yields now. While its not a good idea to jump in with both feet into these stocks just for the dividends it must be noted that further erosion in stock prices is possible. An investor with a well diversified portfolio may want to monitor these stocks and add a little when desired.

Austrlian Stocks with Excellent Yields now (as of Oct 24,2008):

1. Alumina – AWC

Dividend Yield: 12.86%

2.BHP Billiton Ltd – BHP

Dividend Yield: 5.28%

3.SIMS Group Ltd – SMS

Dividend Yield: 9.95%

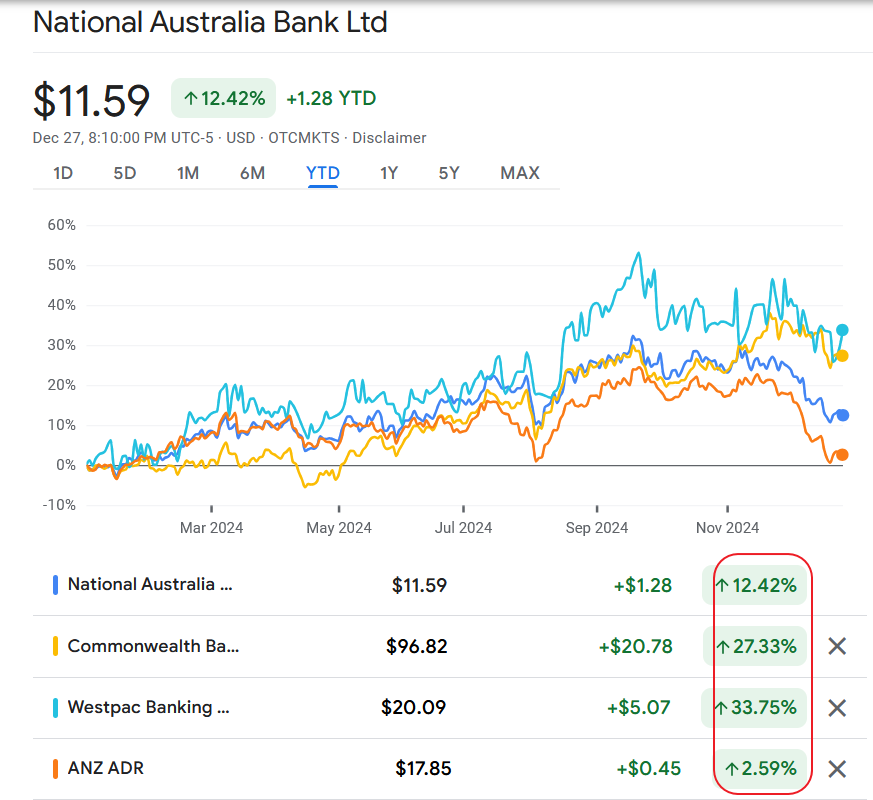

4.Westpac Banking Corp – WBK

Dividend Yield: 9.58%

5.National Australia Bank Ltd – NABZY

Dividend Yield: 12.69%

6.Australia & New Zealand Banking Group Ltd – ANZBY

Dividend Yield: 11.60%

The last two are traded on the OTC markets.