Diversification is one of the simplest and easiest strategies that retail investors can follow to protect their portfolios from high volatility. Holding a wide variety assets across regions and countries and sectors and avoiding timing the market would go long in generating high returns. Trying to predict which sector will be winner during the next downturn is especially hard to predict if not impossible. In addition, a sector that was the winner in the last bear market may turn to out a loser in the next one and vice versa.

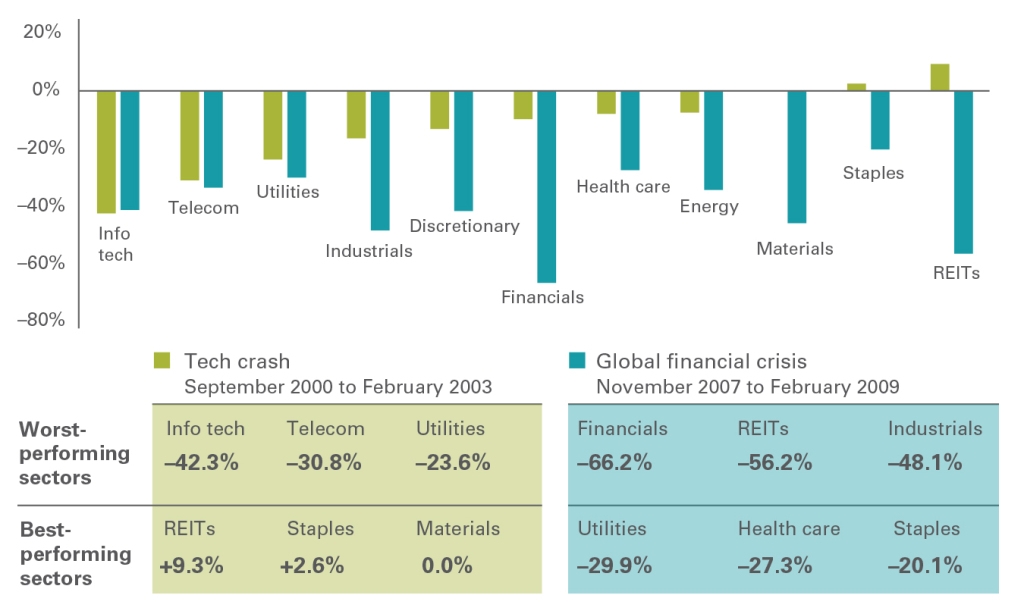

The following graphic shows the performance of select sectors during the dot com collapse and the global financial crisis:

Click to enlarge

Source: Why it’s so hard to predict the next bear market, Chris Tidmore, Vanguard

From the above article:

Many active fund managers try to look into the future. They choose stocks for their funds by trying to predict which market segments will perform well.

The differences in the last 2 bear markets illustrate how hard it can be to identify which sectors and segments of the market are susceptible to a future downturn.

Figure 1 shows that when the tech bubble burst in the early 2000’s, IT, telecom, and utilities were the worst-performing sectors. During the global financial crisis, REITs, financials, and industrials performed poorly. On the other hand, REITs thrived during the tech bubble, and utilities performed the best during the financial crisis.

The key takeaway is that a sector that performs poorly in one bear market may turn out be the best performer in the following one and vice versa.