The S&P 500 fell 2.1% on Friday. In the last week, the index declined by 3.9%. The Dow also fell heavily on Friday with a loss of 668 points. These losses have investors asking serious questions like if stocks are headed for a bear market or if rising interest rates is going to push the economy back into a recession. An article by Shane Oliver at AMP Capital discussed the various possible scenarios on the direction of US stocks.

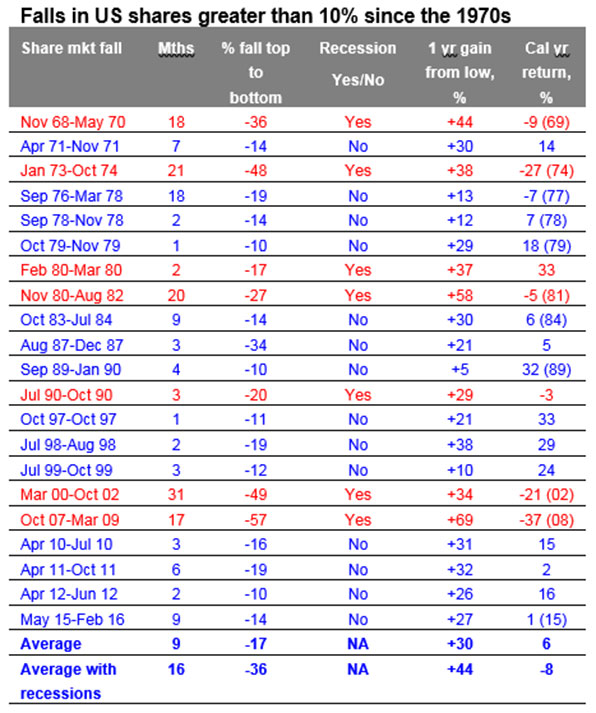

The table below shows the falls of more than 10% since the 1970s for US stocks:

Click to enlarge

Falls associated with recessions are in red. Source: Bloomberg, AMP Capital.

Oliver makes the following observations:

First, share market falls associated with recession tend to last longer with an average fall lasting 16 months as opposed to 9 months for all 10% plus falls.

Second, falls associated with recession also tend to be deeper with an average decline of 36% compared to an average of 17% for all 10% plus falls.

Third, falls associated with recessions are more likely to be associated with negative total returns (ie capital growth plus dividends) in the associated calendar year as a whole with an average total loss of 8% compared to an average total return of 6% across all calendar years associated with 10% plus falls.

Finally, as would be expected the share market rebound in the year after the low is much greater following share market falls associated with recession.

Source: Correction time for shares? by John Oliver, AMP Capital Investors Limited

From an investment strategy standpoint, long-term investors need not be worried of such falls in the US equity market such as the one last week. Stocks never go up constantly only in the upward direction. A strong dose of volatility is needed in order to shakeout weak hands. So instead of focusing on day-to-day market movements investors can stay calm and keep their long-term goals in mind to avoid making any fool-hardy decisions.