An article in The New York Times recently compared the economies of Poland and Ireland. From the article:

WARSAW — With its drab, Soviet-era boulevards and standard-issue glass-and-steel office buildings, Warsaw does not look much like green, elegant Dublin. But there are some striking similarities between Poland today and Ireland in the 1990s.

Like the Irish a couple of decades ago, the Poles are a hardy people battered by history but on the verge of prosperity. Foreign capital is pouring in and investment banks are opening offices, lured by resilient growth and 38.5 million people who are close to shedding the “emerging market†label.

And Poland now, like Ireland then, has its own currency. Being outside the euro zone is working to Poland’s economic advantage.

That is not the only reason Poland is currently that rare species: a financially vibrant member of the European Union. But it is to Poland’s benefit not to be bound by a common currency, at a time when euro zone countries like Ireland will have trouble using cheap exports to grow their way out of trouble.

The author noted that unlike Ireland, Poland is a much larger country with a population of about 38.5 million. The article added:

But Poland was also lucky that, in contrast to Ireland, its banking industry was still small compared with the total size of the economy, with less potential to do damage. Household debt is relatively modest. Poland also benefited from the strong economy in neighboring Germany, which accounts for a quarter of exports.

Output is expected to rise 4 percent or more in 2011, after an estimated 3.6 percent this year. Commercial real estate prices in Warsaw are rising at a 10 percent annual clip. Foreign direct investment is expected to be up 28 percent this year, drawn by the country’s status as one of the few growth stories in Europe. And hardly anybody is complaining about the influx of foreign money.

Poland has one of the most successful economies in Eastern Europe. The Warsaw Stock Exchange has the highest number IPO listings in Eastern Europe last year and it is leading this year also in raising investment capital. Last month when the Warsaw Stock Exchange listed its own shares on the exchange, shares gained 25 percent on the first day of trading.

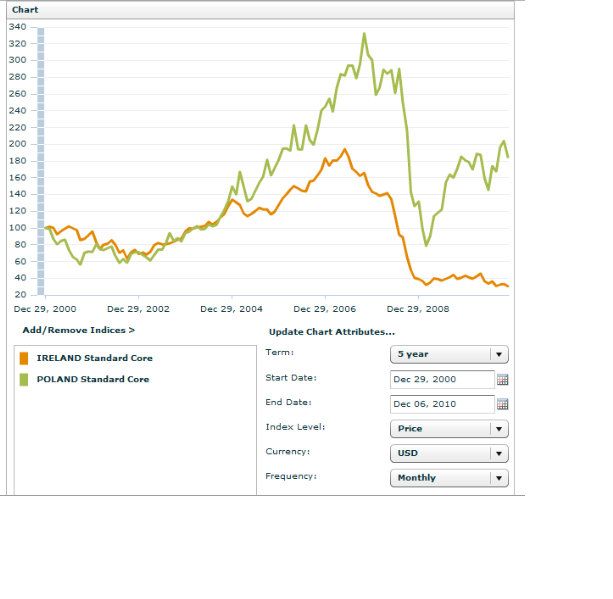

The chart below shows the comparative performance of MSCI indices for Poland and Ireland over the past 10 years:

Source: MSCI Barra

The MSCI Ireland index attained its peak in 2007 and has since been on a downward spiral mirroring the collapse of the Irish economy. As the Polish index recovered from the March 2009 lows, the Irish index declined further after some minor uplift.The gap between the Poland and Irish indices is so wide now compared to 2003 when it was almost non-existent.Investors looking to gain some exposure to Eastern European equities may want to invest in Poland now. Unlike Ireland which will take many years to recovers the Polish economy holds lot of potential for further growth as the country fully integrates into the global marketplace.

Related ETFs:

iShares MSCI Ireland Capped Investable Market Index Fund (EIRL)

Market Vectors Poland ETF (PLND)

iShares MSCI Poland Investable Market Index Fund (EPOL)

Disclosure: No positions