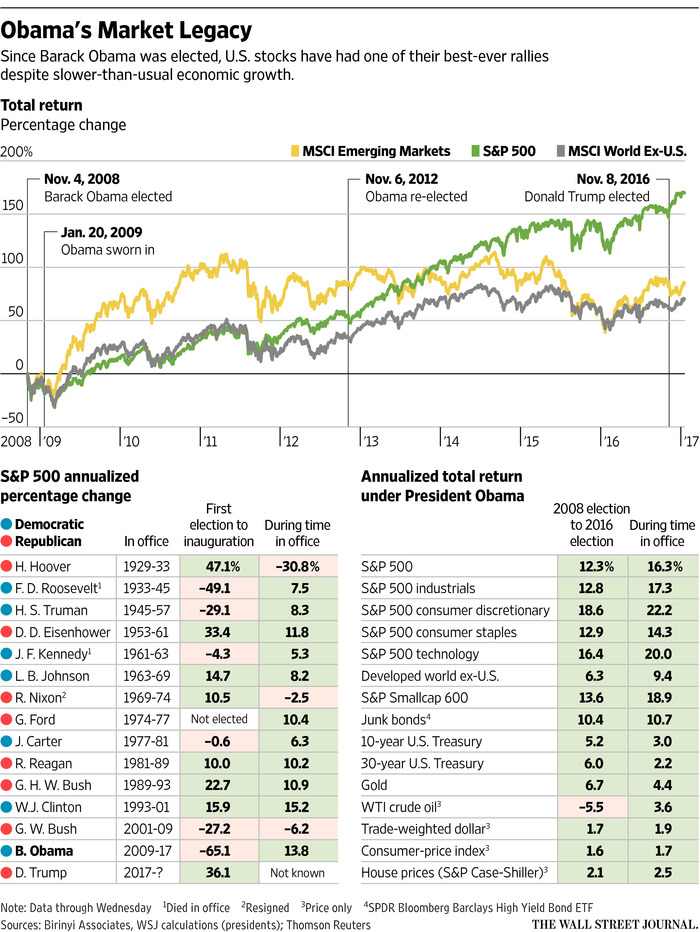

US stocks performed extremely well under former President Obama easily beating foreign stocks as the chart from yesterday’s journal shows below. During his rule, the S&P 500 returned an annualized return of 16.3% including dividends despite a lackluster economic growth. Foreign stocks as represented by MSCI Emerging and World Ex-US indices lagged in performance especially since 2013.

Click to enlarge

Source: Obama’s Stock Market Legacy Is Hard to Beat by James Mackintosh, WSJ

An excerpt from the piece:

Markets are forward-looking, so it makes sense to think the effect of the president would be priced in before he takes office. The big rally since Mr. Trump was elected in November has been predicated on investor hope that he will deliver big tax cuts and fiscal stimulus.

Even if Mr. Trump sticks to investor-friendly policies, though, it is highly unlikely he will beat the market record of Mr. Obama’s time in office, purely because of the starting point. U.S. stocks are far from cheap, and on many valuation measures are already very expensive, while profits are high by historic standards.

Faster economic growth would surely help shares, but it is hard to see how either profits or valuations could grow enough to deliver annual returns of 16% a year for the next presidential term without either a leap in inflation or a gigantic share price bubble, both best avoided.

Investors might not like that news, but Mr. Trump should be unconcerned. His legacy will only be judged by the value of the stock market if it crashes.

Of course, a President is not judged by how the stock market performs. It is the state of the economy that matters. A country can have great economic growth and a poor or average stock market returns and vice versa. This theory is particularly true in emerging markets.

Also checkout: S&P 500 Price Returns vs. Earnings Per Share Over Long-Term: Chart

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard MSCI Emerging Markets ETF (VWO)

Disclosure: No Positions