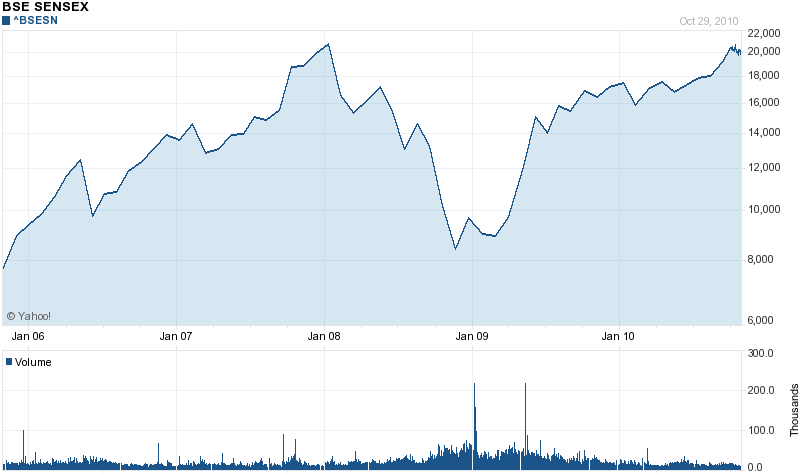

India’s Sensex closed at 20,032 on Friday.This is not far from the all-time high of 20.873 reached in January 2008. During the credit crisis, the index reached a low of 8.160. In just over 18 months the index has rebounded sharply gaining over 150%. This dramatic rise is mostly based on the assumption that the economy will grow at over 8% consistently. However there are many external and internal factors that may put this growth rate into jeopardy. As the hot money continues to flow into the Indian markets, I believe investors need to cautious as the risks for downward movement are higher than the rewards for further rise from current levels.

Sensex Performance – 5 Years:

The following are some of the reasons investors may want to consider before jumping into the Indian markets:

1. Indian equities have become very expensive compared to other emerging markets. For example, the PE of the Nifty index is about 25. India trades at a PE of 23.9 while Brazil and China have P/Es of 12.5 and 14.2 respectively based on Financial Times market data.

2. Foreign investors are pouring money into the markets. They pulled out $14.84 billion during 2008 which led to the crash of the Sensex. But thru September of this year they have plowed back over $15.62B in the markets. Foreign portfolio investment which is highly short-term focused reached over $32.0B in 2009-10 period .

3. Relatively speaking only a few shares of the major companies that are actively are available for trading. Hence large amount of capital chasing a few free-float shares in select companies leads to huge rise in stock prices.

4. Inflation runs at double digits and may rise further if policy makers do not increase interest rates.Inflation remains stubbornly high primarily due to food prices.

5. Some of global commodity prices have risen over 10% this year. This will put pressure on manufacturers to raise prices as their input costs rise.Further increase in prices will lead to higher inflation.

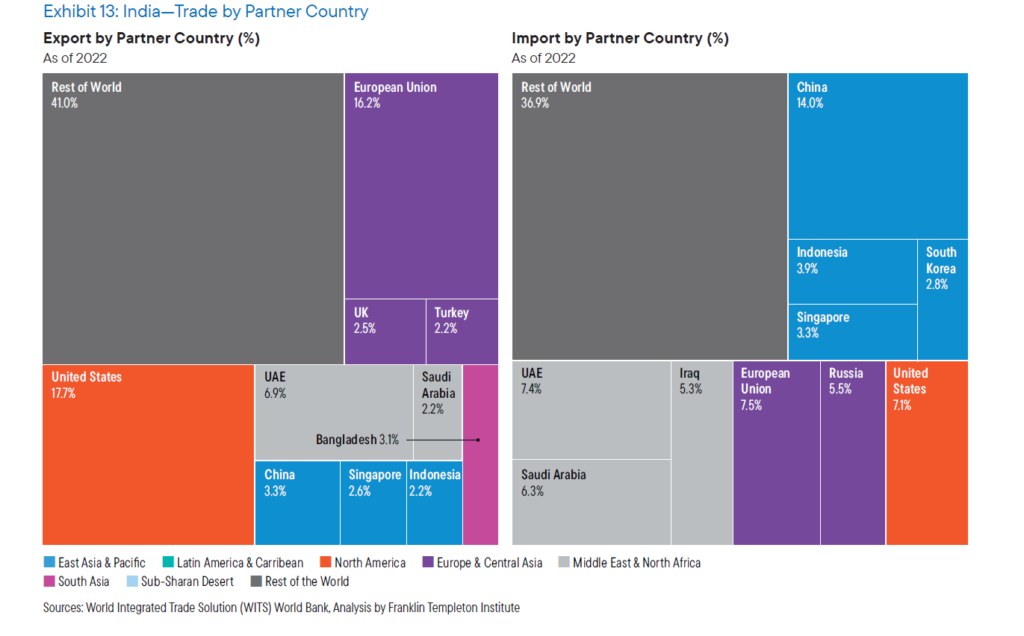

6. Rupee, the Indian currency has appreciated significantly this year against the dollar hurting exports of goods such as textiles, machinery, etc.

7. Unlike Brazil and other countries policy makers have not implemented regulations such as doubling of taxes on foreign capital inflows to slow the flow of capital.Instead regulators and politicians are encouraging the boom of all asset prices continuing the India growth story.

8. While the savings rate in India is one of the highest in the world, domestic investors’ investment in the equity market is very low. The majority of the savings lie in banks earning lower returns adjusted for inflation. This shows the lack of conviction in the markets among the majority of the local population.

9. The corporate debt market is almost non-existent in India. Hence companies have to raise funds either thru the equity markets or banks. The lack of bond markets causes distortion in the channeling of funds from investors to companies.

10. India is a debtor country and the external debt continue to rise due to lavish subsidies offered by politicians.As of October this year, external debt stood at $273.1 billion.

Overall the run-up in equity prices is not justified based on fundamentals and earnings growth. Some experts are predicting a rise of another 10% in the markets due to the upcoming Diwali – the “Festival of Lights” season, liquidity and other factors. However it still does that change the fact that Indian stocks are expensive. “Irrational exuberance” is rampant in the markets which will lead to a painful correction.