Equity markets worldwide have become extrememly volatile in the past few weeks. After the Greek debt drama ended after many months of twists and turns, seemingly out of nowhere China took the center stage. Though the Chinese economy has been in doldrums for a year or more now, investors suddenly turned their attention to China. Changes in an economy is not an overweight process. Rather it takes many months for an economy to either enter the expansion or contracton mode. China’s economy is no different from others in this regard.

With US and other developed stock markets, going up and down violently on a daily basis like a wooden roller coaster, some investors may think of exiting this crazy market and then get back in at a later time. This is not a wise strategy for many reasons. Trying to time the market always works against an investor. While selling may be easy trying to find the clear bottom or entering the market when things calm down is easier said than done.

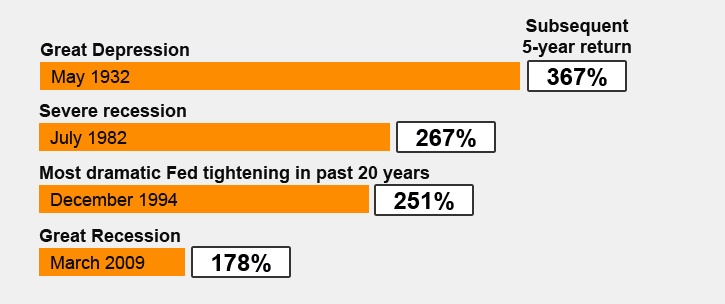

The following chart shows staying invested in volatile times yields excellent returns in the subsequent periods:

Click to enlarge

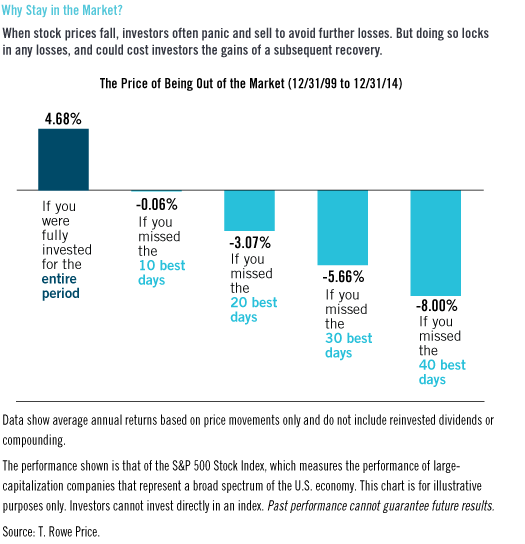

Here is another chart showing the impact of timing the market:

Source: Six strategies for volatile markets, Fidelity

Another reason for staying invested is that markets can move violently up on any day in the future. Since no one can predict the future investors can easily miss out on big gains by not staying in the market.

Click to enlarge

Source: Overcoming Your Market Fears, T.Rowe Price

In summary, the key point to always remember is that one should not panic and sell on a big down day. Instead an investor can advantage of cheaper prices and add in phases if they have the funds available.