I wrote a post about the dividend tax rates across countries over the weekend. In this post lets take a look at the Integrated Top Long-term Capital Gains Tax Rates.

Click to enlarge

Source: Corporate dividend and capital gains taxation: A comparison of the United States to other developed nations, April 2015, Alliance for Savings and Investment (ASI)

From the research report:

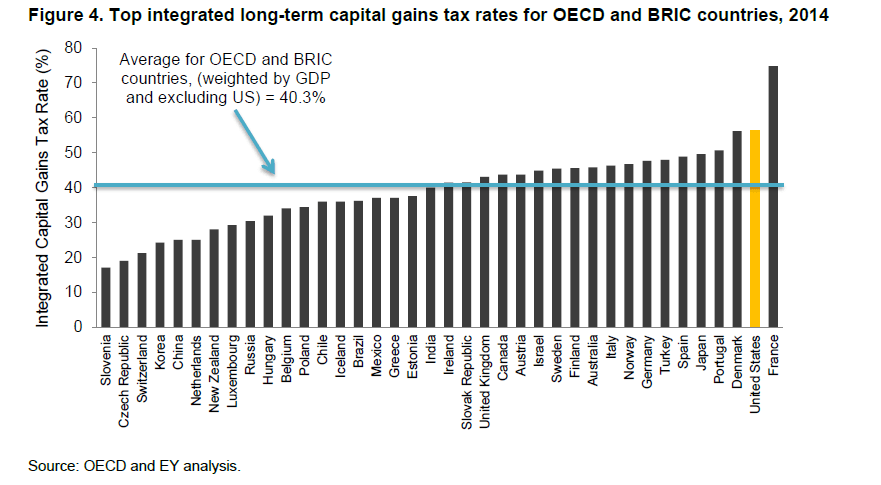

The United States also has one of the highest top integrated long-term capital gains tax rates among developed nations (Figure 4). The top US integrated long-term capital gains tax rate of 56.3% is significantly above the 40.3% GDP-weighted average rate prevailing among OEDC and BRIC countries, a 16 percentage point difference. Among the OECD and BRIC countries, only one country, France (74.9%) has a top integrated long-term capital gains tax rate exceeding that of the United States (56.3%). This is due to the relatively high corporate income tax rate of the United States relative to the OECD and BRIC countries (excl. US) (39.0% relative to 28.1%) and the relatively high long-term capital gains tax rate (28.3% relative to 17.5%).

The U.S. has the second highest tax rate after France. “Integrated” tax means taxes paid by both companies and investors. So the 56.3% does mean individual investors pay more than half of their long-term capital gains to Uncle Sam. For tax purposes, long-term implies investments held more than just one year.