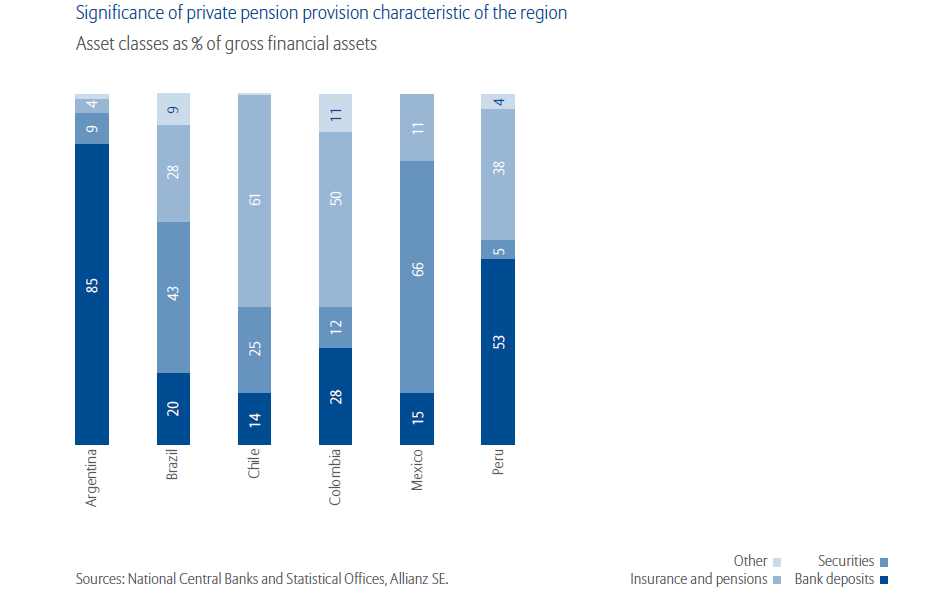

The financial assets held households can be of many types including bank savings deposits, insurance policies, pensions, bonds, stocks, etc. Usually households’ total financial assets is split between a variety of asset classes. Globally the percentage split among the asset classes vary from region to region and even country to country. For instance, Germans are big savers in terms of bank deposits and do not prefer to hold stocks. But generally Americans prefer stocks to bank deposits. The reasons for this difference between two countries can be attributed to many factors including culture, tax policies, interest rates, etc.

In this post lets take a quick look at how Latin American households’ financial assets are divided among the various asset classes.

Click to enlarge

Source: Allianz Global Wealth Report 2014, Allianz

Among Latin American countries, households in Argentina have the highest percentage of their financial assets in bank deposits. Argentines have just 9% of their total financial assets in stocks which are risky. Households in Mexico, Brazil and Chile have low percentage of bank deposits compared to other asset classes.Mexicans and Brazilians have the highest percentage of their assets in stocks at 66% and 43% respectively. Households in Chile have the highest percentage of their financial assets in insurance and pensions due to government regulations there.

Also checkout:

- Duration of Stock Holding Periods Continue to Fall Globally

- Stock Market Participation Rates Across Countries