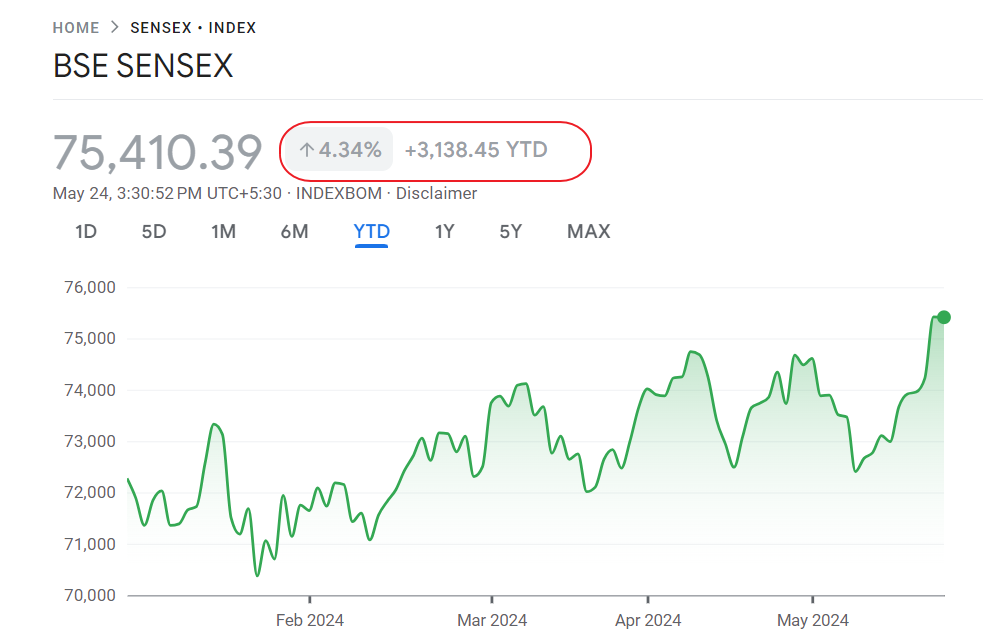

The main stock index in India, the Sensex is up 80% in local currency YTD. After falling to about 8000 in March this year it has more than doubled and closed at 17,360 on Dec 24th. YTD the index has risen by 81%. Many investors are now wondering if the Sensex repeat this incredible performance next year.

Before investing in India in 2010, investors may want to consider the following points:

1. In many sectors, companies have squeezed higher profits from flat sales this year. This may not continue next year.

2. Due to the global rebound in commodity prices, the commodity sector performed extremely well relative to other sectors. However commodity prices have started to stabilize and pressure is building up.

3. Due to excessive speculation, the real estate sector also rose sharply and is unsustainable at current levels.

4. The P/E ratio currently stands at 21. This is nearly double the P/E ratio of 11 in March. The P/E ratio of 21 is very high historically and the market has become expensive. The average P/E for the Sensex is 18.

5. Food inflation is running at double digit rates due to government intervention in the market and bad monsoon. The government of India sets prices for many basic food commodities.

6. The states and the central governments are borrowing and spending like drunken sailors without regard to long-term effects on the economy.

7. A large portion of the growth in the GDP in recent quarters have resulted from government spending on infrastructure projects due to the stimulus packages.When the stimulus programs are withdrawn growth will be tempered.

ETFs: The Complete List of India ETFs and ETNs Trading on the US Markets