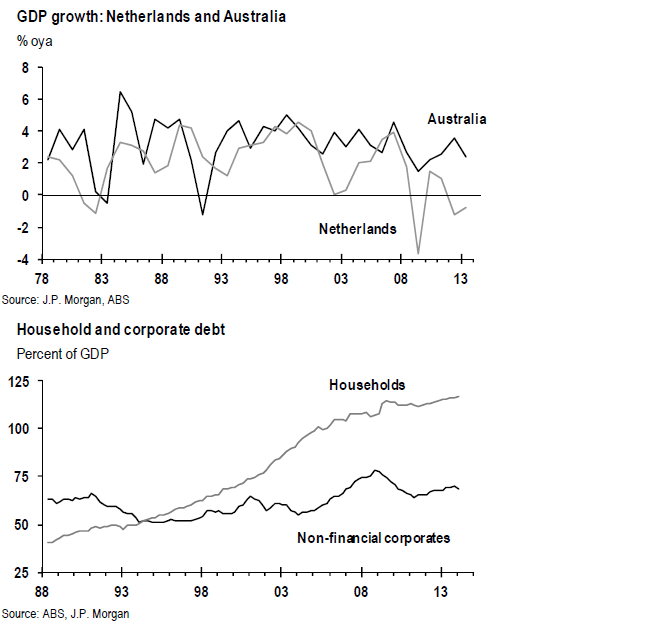

The Australian economy has performed relatively well among the developed economies. In fact, Australia escaped largely unscathed during the global financial crisis of 2008-09 when Europe and the U.S. economies went into a tailspin. According to a report by J.P.Morgan Australia has avoided recession for 23 years even beating the performance of The Netherlands.

Australia’s economy has had positive growth for the past 23 years. The Dutch economy had 27 years of growth until the global financial crisis broke the record run when the GDP growth fell by 4.2%.

The JP Morgan report does not forecast a recession for the Australian economy. However it does point out certain negative factors that could cause a recession. One of the negative factor that investors need to be worried about is that the household debt remains excessive compared to corporate debt (measured relative to GDP) as shown in the chart below:

Click to enlarge

Source: JPM Global Data Watch, J.P. Morgan

Australian companies have reduced their debt from 78% of GDP in 2008 to 69% now. But households have continued to accumulate debt at a steady pace over the years.Currently the debt to income ratio stands at 1.5 times and is among the world’s highest.

With global demand for natural resources continuing to decline the unemployment rate could spike from current low levels leading to problems in the housing market. Hence investors in Australian equity markets have to be cautious and hedge their bets accordingly.

Related ETFs:

Disclosure: Long EWN