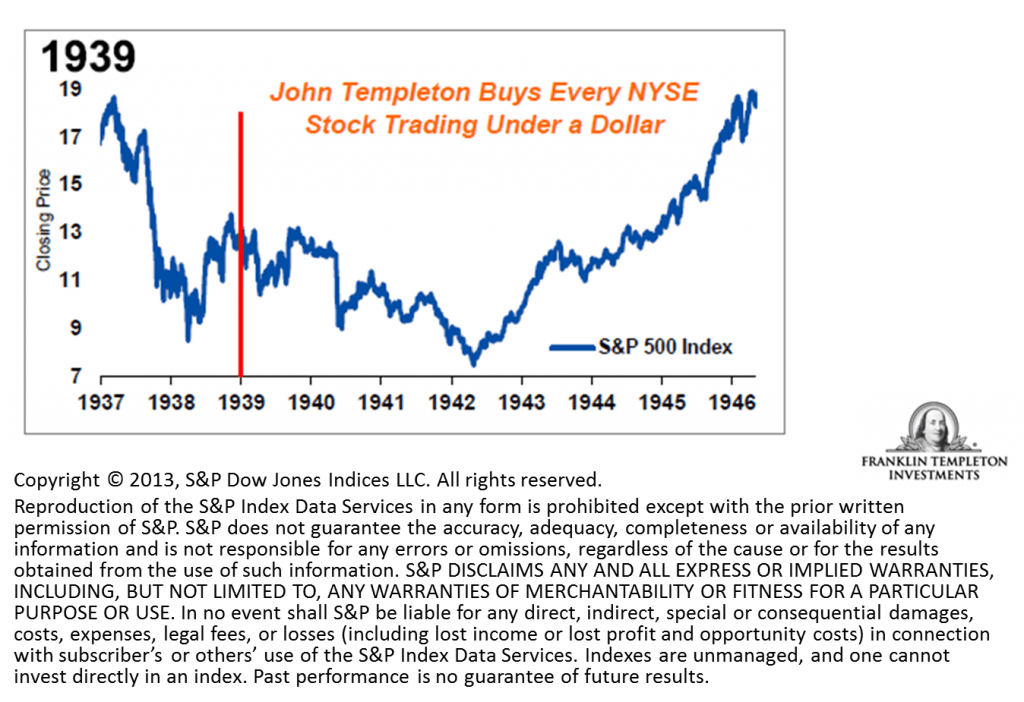

Sir John Marks Templeton was a pioneer global investor who founded the Templeton Mutual Funds. An extraordinary man he was very smart even in his early life. He was a superb stock picker. In 1939 when investors were fleeing the markets due to World War II he bought 100 shares of each stock that was trading under a dollar on the New York Stock Exchange. When the US markets recovered and shot up strongly in the buildup to the war, he made many times over his original stock investments.

One of his famous quote on long-term contrarian investing:

The best bargains are not just stocks or assets whose prices are down the most, but rather those stocks having the lowest prices in relation to future potential earnings power.

Click to enlarge

Source: Once-a-Generation European Opportunity?, Franklin Templeton Investments