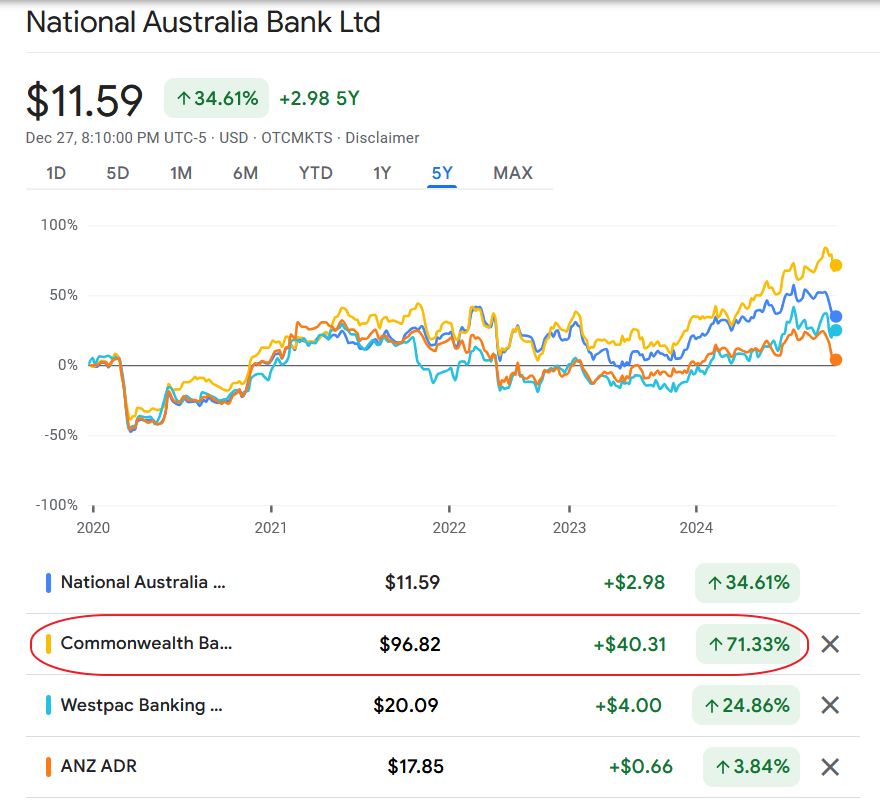

Australian bank stocks have had a great run this year. Among the Big 4, Commonwealth Bank has been the stand out with its stock up by 42% in the domestic market excluding dividends. Since reaching the peak the stock has fallen slightly and closed yesterday with a return of about 40% YTD. It should be noted that if dividends are included returns will be even higher. Though earnings have declined Commonwealth’s PE ratio has soared to 28x leading to the amazing returns.

The following chart shows the YTD return of the Big Four Banks on the US market:

Click to enlarge

Source: Google Finance

The chart below shows the 5-year returns:

Click to enlarge

Note: The returns shown above DO NOT include dividends.

Source: Google Finance

The current dividend yields of these stocks are listed below with their tickers on the US market:

1.Company: ANZ Group Holdings Limited (ANZGY)

Current Dividend Yield: 5.99%

2.Company: Commonwealth Bank of Australia (CMWAY)

Current Dividend Yield: 3.22%

3.Company: National Australia Bank Limited (NABZY)

Current Dividend Yield: 4.76%

4.Company: Westpac Banking Corp (WEBNF)

Current Dividend Yield: 7.07%

Note: Dividend yields noted above are as of Dec 27, 2024. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long NABZY and WEBNF