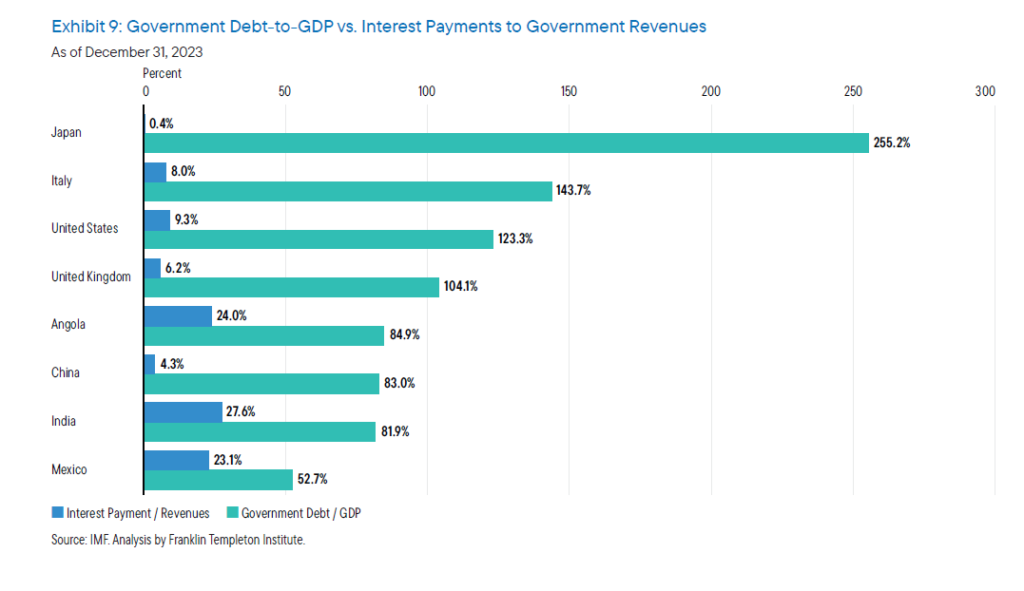

Many investors worry about the debt-to-GDP ratio when evaluating a country’s economy. For example, the US national debt is over $34.5 Trillion according to the US Treasury. The debt-to-GDP ratio stood at 124.7 % of the nominal GDP in March 2024. The record low was at 31.8%. The cost service the debt amounted to 2.4% of the GDP in 2023. In terms of dollars, total net interest payments was $658 billion in 2023. This figure is indeed small when compared to other countries. The key point is ability to service the debt and not the total debt outstanding. I came across the below chart that compared the debt-to-GDP ratio against the interest payments to government revenues for select countries in 2023:

Click to enlarge

Source: The demographic wave: The tide is going out, Franklin Templeton Institute

For many developing and frontier countries, the debt-to-GDP is not only high but the servicing cost of the debt is also high. For instance, Angola spent 24% of its revenue to service its 85% debt-to-GDP ratio. Or to put it another way, nearly one-fourth of its revenue went to interest payments. For Italy on the other hand, debt servicing cost was just 8%. So this gives the country the ability to access further credit unlike Angola. For India and Mexico, servicing cost was over 27% and 23% respectively in 2023.