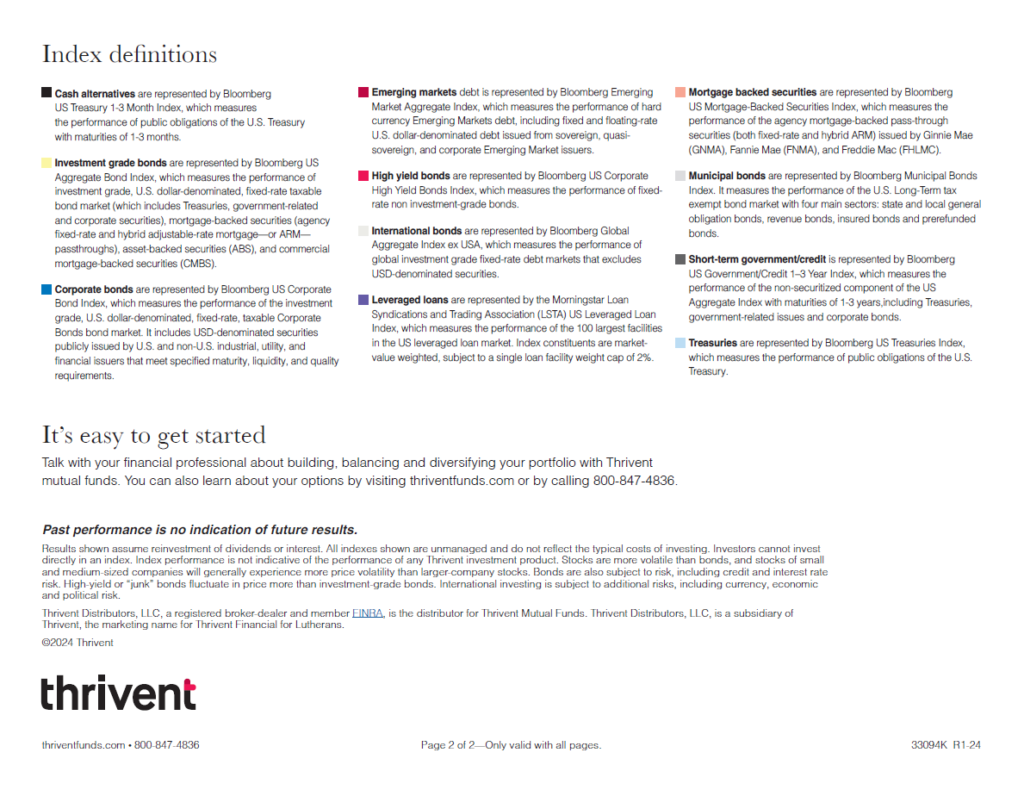

One of the simplest and easiest strategies for reducing risk with investing is diversification across asset classes. In addition to equities, it is important to hold fixed-income assets in a portfolio. Bonds can provide a cushion during adverse market conditions and one can also reinvest coupon payments in equities for instance or reinvest in other bonds. Cash also generates a decent return in this high interest time. I came across the below showing the annual return for fixed-income assets from 2014 to 2023. In the past 10 years, high-yields have earned positive returns in most of the years. Historically cash been the worst performer and earned poor returns in the period noted above as well.

Click to enlarge

Source: Thrivent

Related ETFs:

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- Vanguard Total Bond Market ETF (BND)

- SPDR® Barclays High Yield Bond ETF (JNK)

- iShares Core Total U.S. Bond Market ETF (HYG)

- iShares TIPS Bond ETF (TIP)

Disclosure: No positions