The housing market in Australia is one of the most expensive in the world. High prices never seem to slow down or decline. Though the country is large much of the population is concentrated on a few coastal cities. One of the factors that was always suspected but hardly discussed in the media is the role of immigration. The question that should be answered is how much immigration affect housing shortages and prices. Canada is another resource-based economy that faces a similar problem as well. The majority of the population are crammed into a few big cities and most live closer to the US border. Despite being one of the largest countries in the world in terms of land, housing prices in cities like Toronto and Vancouver are a joke. In these cities a million dollars will get one an average house or in some extreme cases a small shack.

With that said, Dr.Shane Oliver at AMP capital argues that Australian immigration must be lowered significantly in order to reduce supply shortfalls and meet industry capacity. From the article:

Australia’s surging population

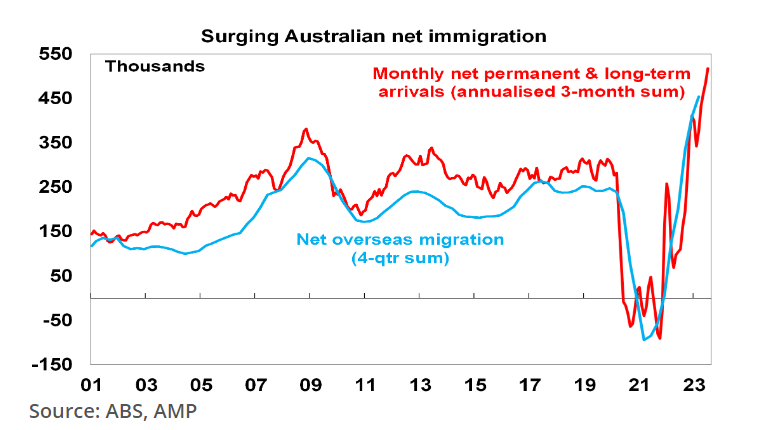

March quarter data showed that Australia’s population rose by 563,000 or 2.2% over 12 months, with 454,000 of that coming from immigration. Permanent and long-term arrival data up to July suggest that the surge in immigration is continuing and we are on track for net immigration of 500,000 or more in the last financial year.

Mr.Oliver further discussed the housing affordability or lack there off, housing supply and of course the role of immigration. He concludes by stating the number of immigrants allowed in must be cut by about 50%. A brief excerpt from the piece:

Immigration levels need to be lower

There are a lot of things that need to be done to improve housing affordability: making it easier to build more homes but in a way that does not lead to ever worsening urban congestion and compromise the very things that make Australia great (yes like many Australians I admit to being a NIMBY); encouraging greater decentralisation to regional Australia to take pressure off cities; and tax reform in terms of replacing stamp duty with land tax and reducing the capital gains tax discount. But it’s impossible to escape the conclusion that immigration levels need to be calibrated to the ability of the home building industry to supply housing. This is critical. Current immigration levels are running well in excess of the ability of the housing industry to supply enough homes exacerbating an acute housing shortage and poor housing affordability.

Our rough estimate is that if home building supply capacity is 200,000 dwellings a year (as we managed in the five years to 2022) then immigration levels need to be cut back to 260,000 from around 500,000 now. But if capacity is just 180,000 dwellings pa or we want to reduce the accumulated supply shortfall by say 20,000 dwellings a year then immigration should be cut back to near 200,000 people a year.

Source: Oliver’s insights – immigration and housing affordability, Dr.Shane Oliver, AMP Capital

The residential real estate market in the US is another bubble as well. I haven’t seen any article from economists on the impact of immigration- both legal and illegal – on the housing market.