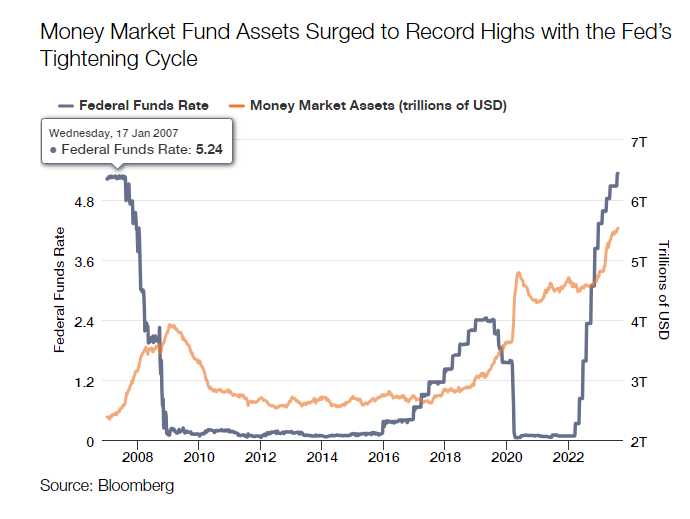

The Federal Funds Rate has increased sharply since the spring of 2022. After slashing interest rates to almost zero during the Covid pandemic the Federal Reserve embarked on a relentless process to raise interest rates to current target levels of 5.25% to 5.50%. Accordingly rates on Money Market Funds have rise to over 5%. No wonder assets in these funds have soared since last year and are headed towards the $7.0 Trillion mark. The following chart shows the correlation between fed funds rate and money market assets:

Click to enlarge

Source: Is Cash Really King? Why Bonds Should Reign, Thornburg

Related funds:

- Vanguard Federal Money Market Fund (VMFXX)

- Vanguard Treasury Money Market Fund (VUSXX)

- Schwab Value Advantage Money Fund – Investor Shares (SWVXX)

- Schwab Treasury Obligations Money Fund – Investor Shares (SNOXX)

- Fidelity Money Market Fund (SPRXX)

- Fidelity Government Money Market Fund (SPAXX)

Disclosure: Long SWXXX