A recession is predicted this year by many economists and forecasting experts. Economic recessions follow expansions and vice versa. With that in mind, have you ever wondered how equities perform during a recession?

According to a research report by Tina Fong at Schroders, based on the past 100 year data US stocks always hit the bottom after we are in a recession. Stocks have always nearly begun to recover before the recession ended. So even if the economy goes into a recession sometime this year, it is impossible to predict when stocks might reach the trough and when they would bounce back. As I have discussed many times in this blog before, timing the market is a not a smart strategy. This applies any investments during a recession also. From the report:

The S&P 500 reaches a low during recessions

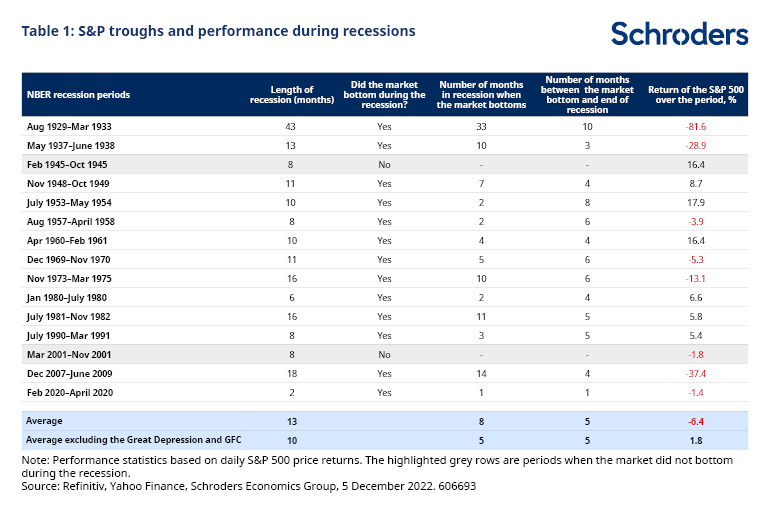

It would be very unusual for the S&P 500 to bottom before the recession has even started (see Table 1, below ) which makes us fear that the recovery in markets since October could transpire to be another bear market rally.

The index has reached a low during nearly every recession officially dated by the NBER (National Bureau of Economic Research) since the 1920s. So, once a recession has begun, and despite everything possibly feeling very gloomy, investors do need to be prepared to look through it at some point.

There have only been two episodes when US equities only troughed after the recession had ended. These were relatively short-lived recessions triggered by the major events of World War II and the dotcom bubble bursting.

Click to enlarge

Source: How do US stocks and earnings usually perform during a recession?, Schroders

On average, the US stock market takes around five to eight months to find a floor during recessions and tends to bottom five months before the end of recessions.

If the downturn is more severe and longer in duration, it has taken even longer for the S&P 500 to fall to a low.

During the Covid-19 recession in 2020, the US stock market troughed less than a month after the start of the shortest recession in history. Back then, markets had looked through the collapse in economic activity from the self-imposed lockdowns and expected a sharp rebound in growth.

By contrast, the Great Depression was the longest US recession of the 20th century, and it took nearly three years before the S&P 500 reached its bottom. It was also the worst episode in terms of price performance as the market was over 80% down over the period. And, while the index has delivered negative returns on average during recessions, the picture is distorted by heavy losses suffered during the Great Depression and the Global Financial Crisis (GFC).

The key takeaway is that investors should focus on their long-term goals and continue with their periodic investments instead of worrying about recessions. In fact, if equities decline heavily during a recession it is a wise idea to pick up quality names on the cheap.

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No positions