One of the best ways to build wealth with equities is to invest in growth stocks. Most growth-oriented generally do not pay any dividends as their focus is on growing. Some of the current popular growth stocks include the likes of Tesla(TSLA), Amazon(AMZN), Nvidia(NVDA), Apple(AAPL), Alphabet(GOOG), Facebook(FB), etc. However the main issue with this strategy is that it is difficult if not impossible to identity the growth superstars when they were young. Besides many of these mega growth stars were dead money for a few years while they struggled with competition or directions when they were much smaller. For example, Apple was abandoned by investors many times and left for dead years ago. Similarly Amazon was a money loser and never made any profit for years and years during and after the dot com bubble. The number of investors that held these companies thru all those years is probably very small. In addition, growth stocks can stop growing at any time or can even go bankrupt.

So the next best strategy to generate excellent returns over the long-term is to invest in dividend-paying stocks and reinvesting the dividends. Even better is to go with dividend growers. Companies that consistently grow their dividend payouts year after year are ideal to build wealth due to the effect of compounding.

I came across an excellent article that showed the power of dividend growers using three world-class companies as examples. From the article by Caroline Randall at Capital Group:

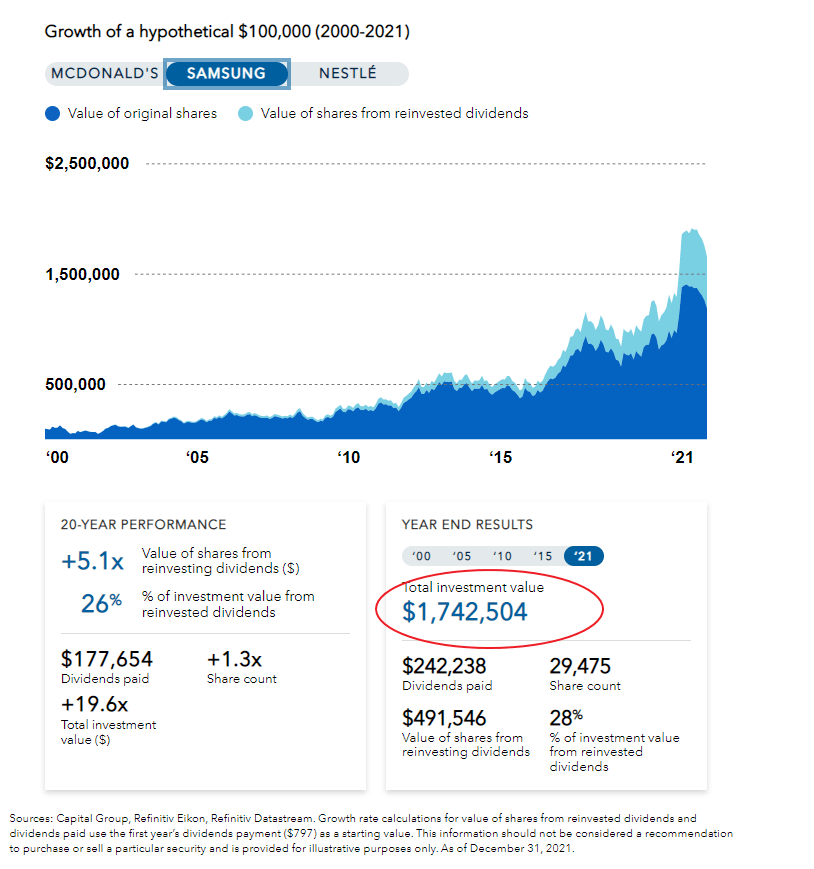

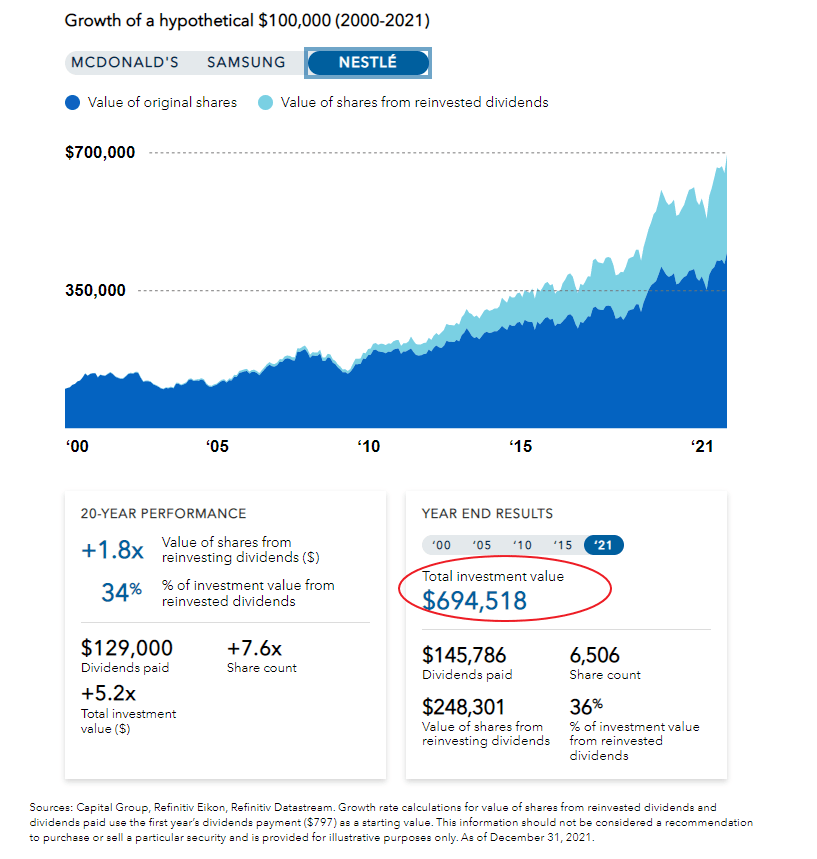

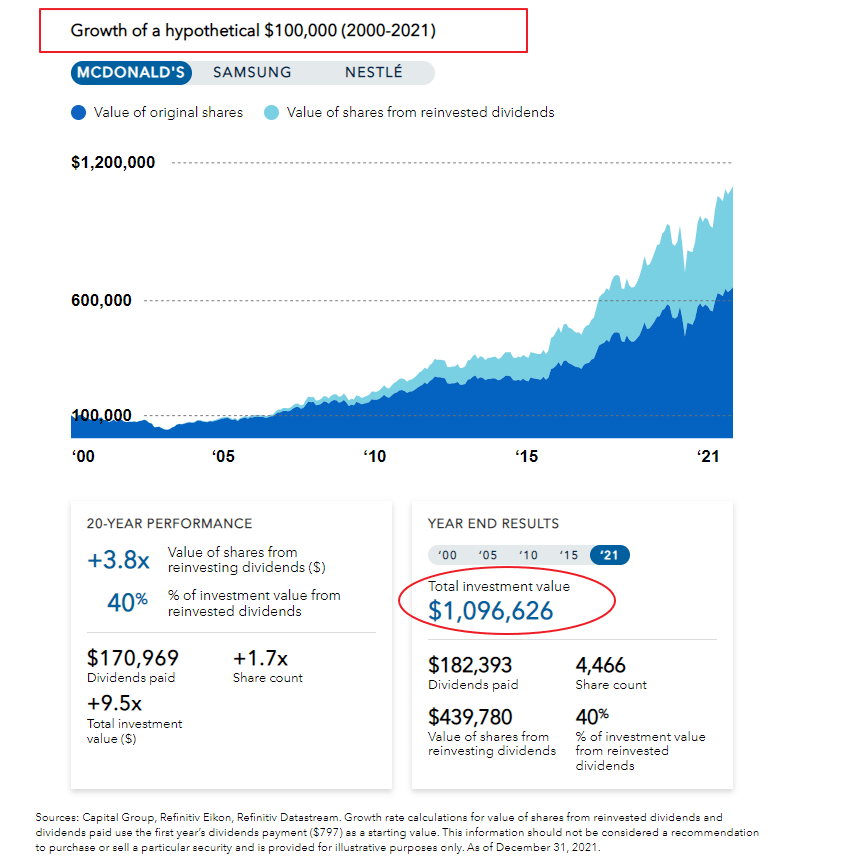

Our interactive chart shows the returns for hypothetical $100,000 investments in three historically consistent dividend growers — McDonald’s, Nestlé and Samsung — for the 20 years ended December 31, 2021. Toggle by company and year-end results to see how those initial investments would have fared over the two decades, with all dividends reinvested.

Growth of $100K over 20 years – McDonald’s (MCD):

Samsung:

Nestle (NSRGY):

Note: For an interactive version of the charts please visit the linked article.

Source: What $100k could have become in 20 years, Capital Group

The original investment of $100K in McDonald’s (MCD) would have grown to nearly $1.1 Million in 20 years and 40% of that growth came from just reinvested dividends. This is fascinating indeed.

Disclosure: No positions