Growth stocks are getting hammered this year for good reason. In a rising interest rate environment growth stocks perform poorly relative to value stocks. When rates increase investors are reluctant to pay premiums for companies whose profits are projected in the future. Companies with no earnings but great ideas or projections fare even worse. Many such firms that became darlings during the past two years are already down significantly.

Below is an excerpt from an excellent article by Eric Savoie at RBC Global Asset Management:

Growth stocks underperformed amid rising interest rates

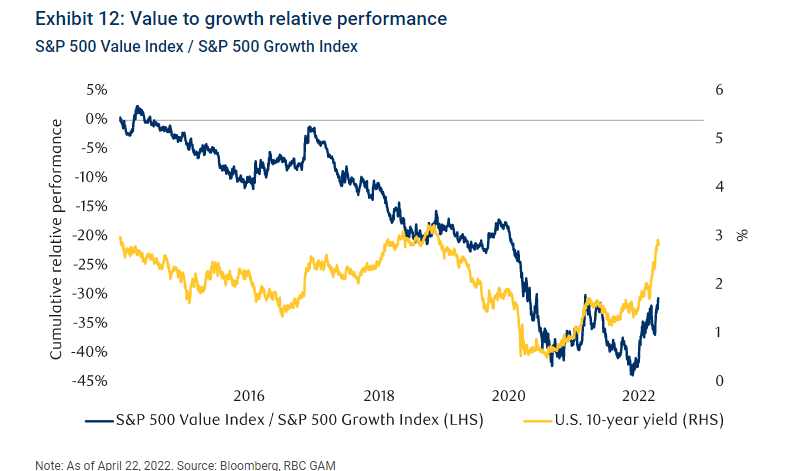

One of the major equity themes so far this year has been the underperformance of growth stocks given their heightened sensitivity to changes in interest rates. The S&P 500 growth index is down 17% year-to-date and very close to its March low, whereas the S&P 500 value index is only down 2.6% year-to-date and remains relatively close to its record high. As interest rates rise, investors are less willing to pay up for the promise of much higher profits generated by growth stocks far out into the future and prefer more attractively priced value stocks (Exhibit 12). That said, even though growth stocks have faltered relative to value stocks, the recent pullback pales in comparison to the significant gains generated by growth stocks over the last several years. Growth stocks could continue to come under pressure in an environment where central banks remain hawkish, inflation proves more difficult to calm and yields push even higher.

Source: Investors on edge as central banks buckle down to fight inflation and rates rise, RBC

With interest rates projected to rise further thru the rest of the year, growth stocks are likely to be more volatile and decline. Unprofitable companies are best avoided.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- Vanguard Growth ETF (VUG)

- SPDR Portfolio S&P 500 ETF (SPLG)

- S&P MidCap 400 SPDR ETF (MDY)

Disclosure: No positions