Tax rates vary by state in the U.S. From sales tax to income tax and everything in between rates differ from one to another. A few states do not have either income or sales tax at all. For instance, there is no personal income tax in the state of Florida. Recently I learned that not all states exempt sales tax on grocery items. For years I assumed that in all states food items were not taxes. Of course this excludes soft drinks and other non-essential items. But there are a few states that charge a reduced sales tax on groceries or the full sales tax rate. So in these states low-income people are forced to pay taxes even on basic necessities for survival such as a bread loaf or flour for example. The Southern states of Alabama and Mississippi fall in this category.

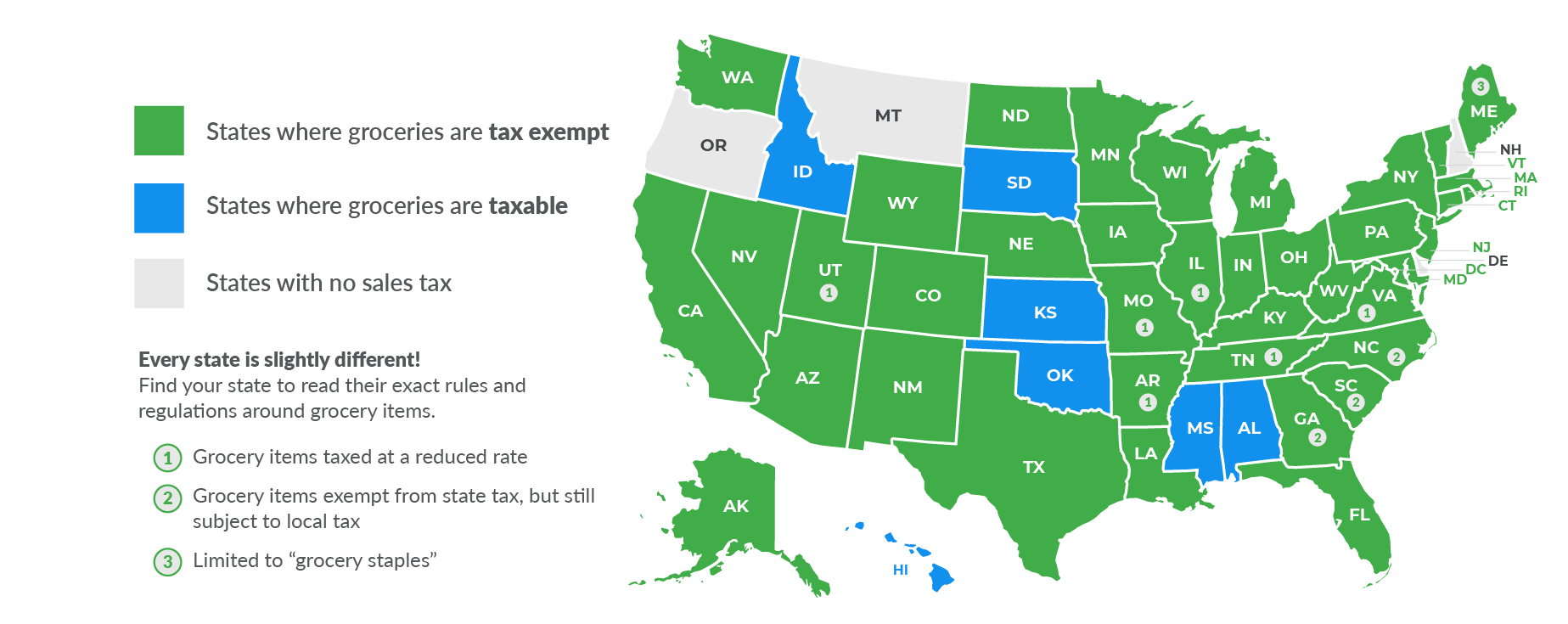

The following graphic shows the the sales tax on grocery items by state:

Click to enlarge

Source: Sales Tax on Grocery Items, TaxJar

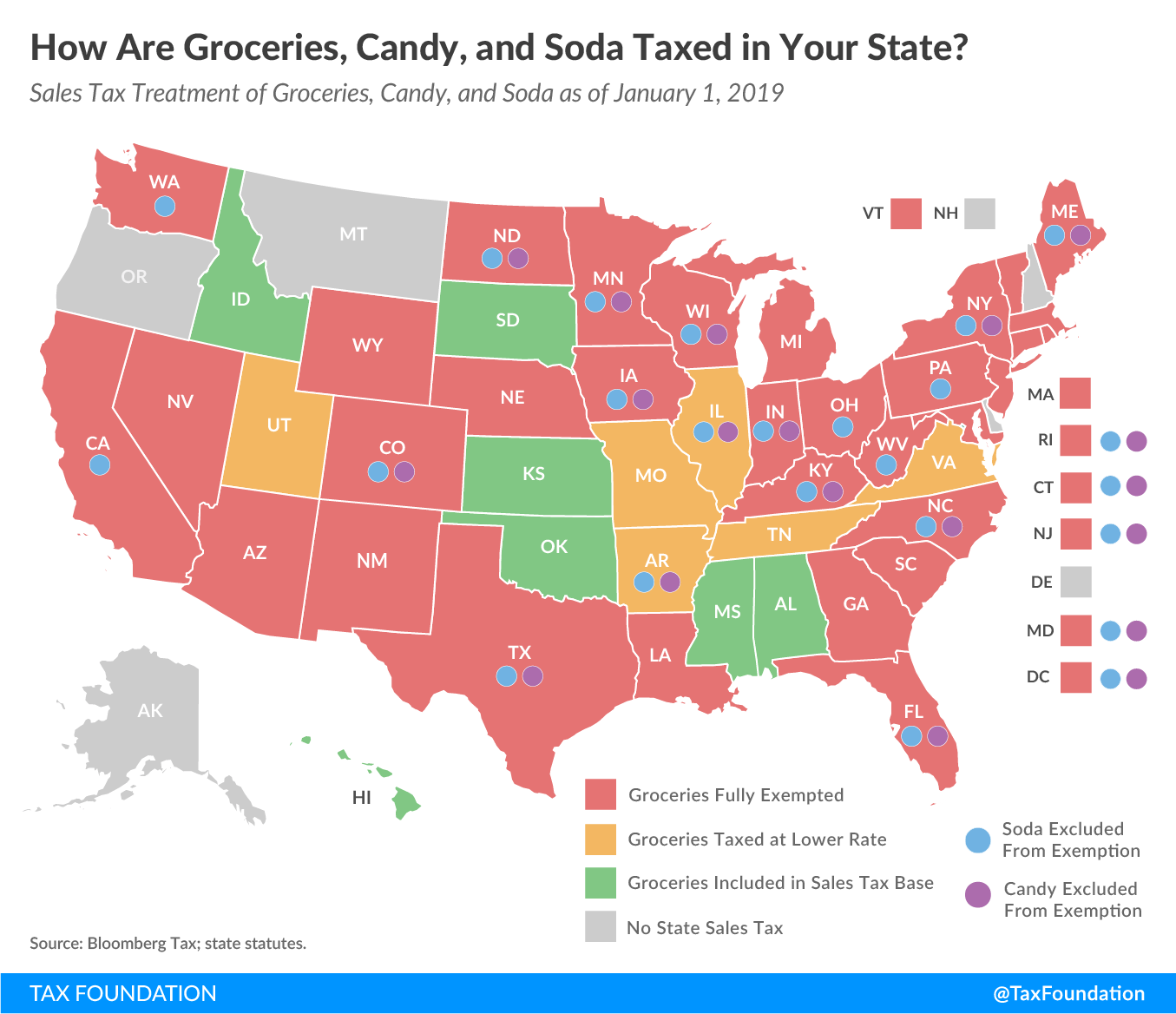

The chart below shows tax rates on candy and soda in addition to groceries:

Click to enlarge

Source: How Does Your State Treat Groceries, Candy, and Soda?, Tax Foundation