Investing in equities involve analyzing a multitude of factors. Some of these factors include worrying about Trump’s impeachment, who will win the US Presidential elections net year, US-China Trade wars, oil prices, Fed’s QE programs, value of the dollar, etc. All of these factor’s are beyond an investor’s control. One of the few factors that an investor can control is fees. Typical fees include annual fees, investment advisory fees, 12b-1 fees, commissions, etc. These fees vary from one firm to another. Though some of these fees may seem small over the long run they will reduce a portfolio’s return by a huge amount. So investor’s have to carefully analyze the impact of fees when making their investments. Simply ignoring small fee rates such as annual 0.5% or 1% is foolish.

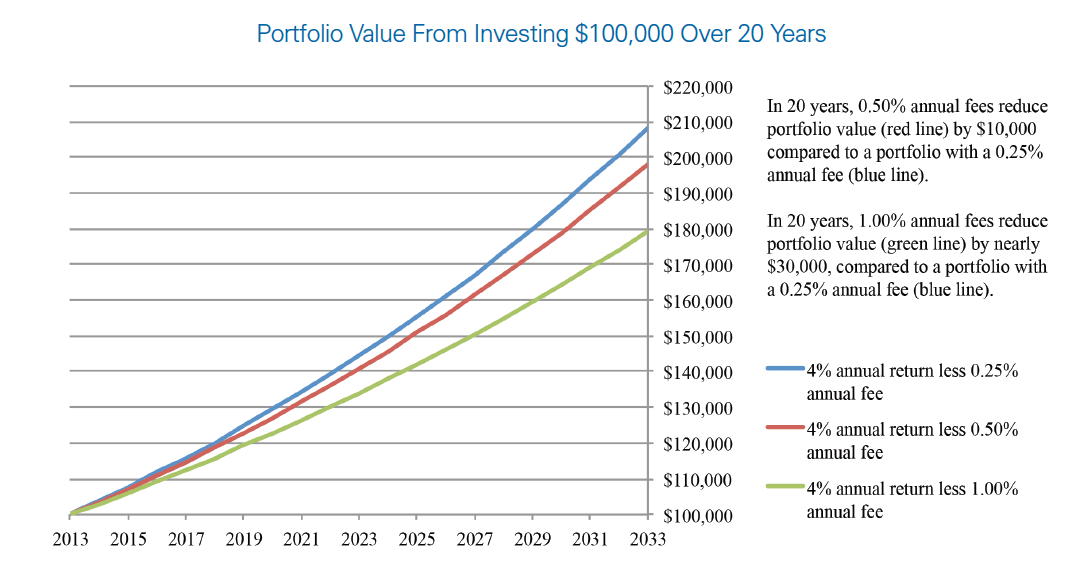

The following chart shows the impact of fees at 0.25%, 0.50% and 1% for a $100,000 investment over 20 years:

Click to enlarge

Source: How Fees and Expenses Affect Your Investment Portfolio, SEC

Over 20 years, someone who chose a 0.25% fee option will have nearly $30,000 more than someone who chose a 1% fee option. This is significant amount indeed.

It should be noted the SEC uses a potential return of 4%. If this figure was higher say 7% or 10% then the fees over the same 20 years will be even higher as the fees are deducted annually.

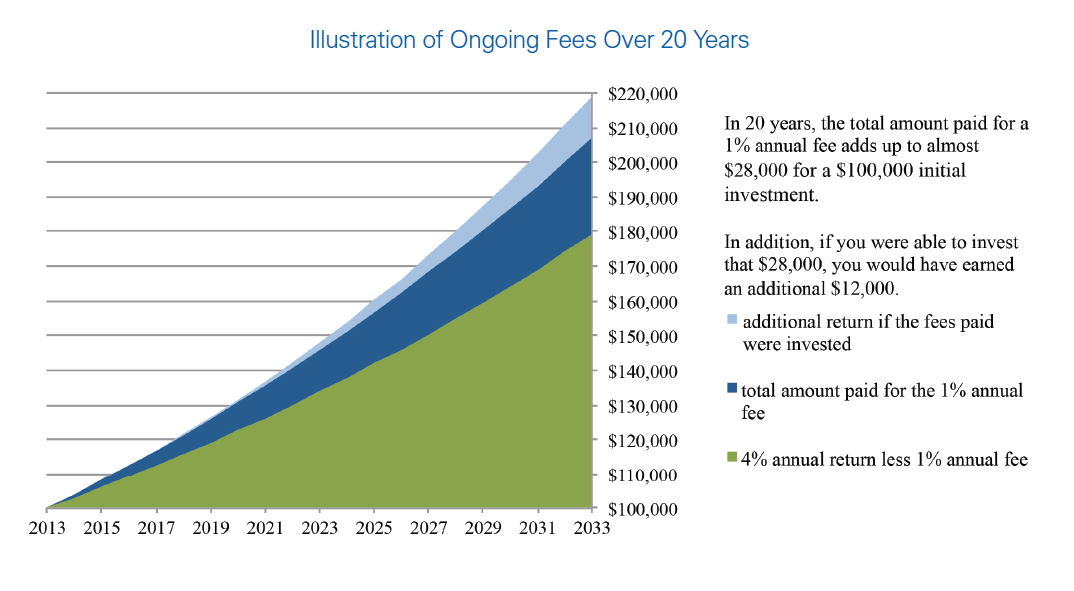

In addition, there is also the impact of opportunity costs. This simply means fees that are paid annually could have been invested to generate additional returns for the portfolio. The following chart illustrates this logic:

Source: How Fees and Expenses Affect Your Investment Portfolio, SEC

One way investors can reduce fees paid is going with ETFs than mutual funds.