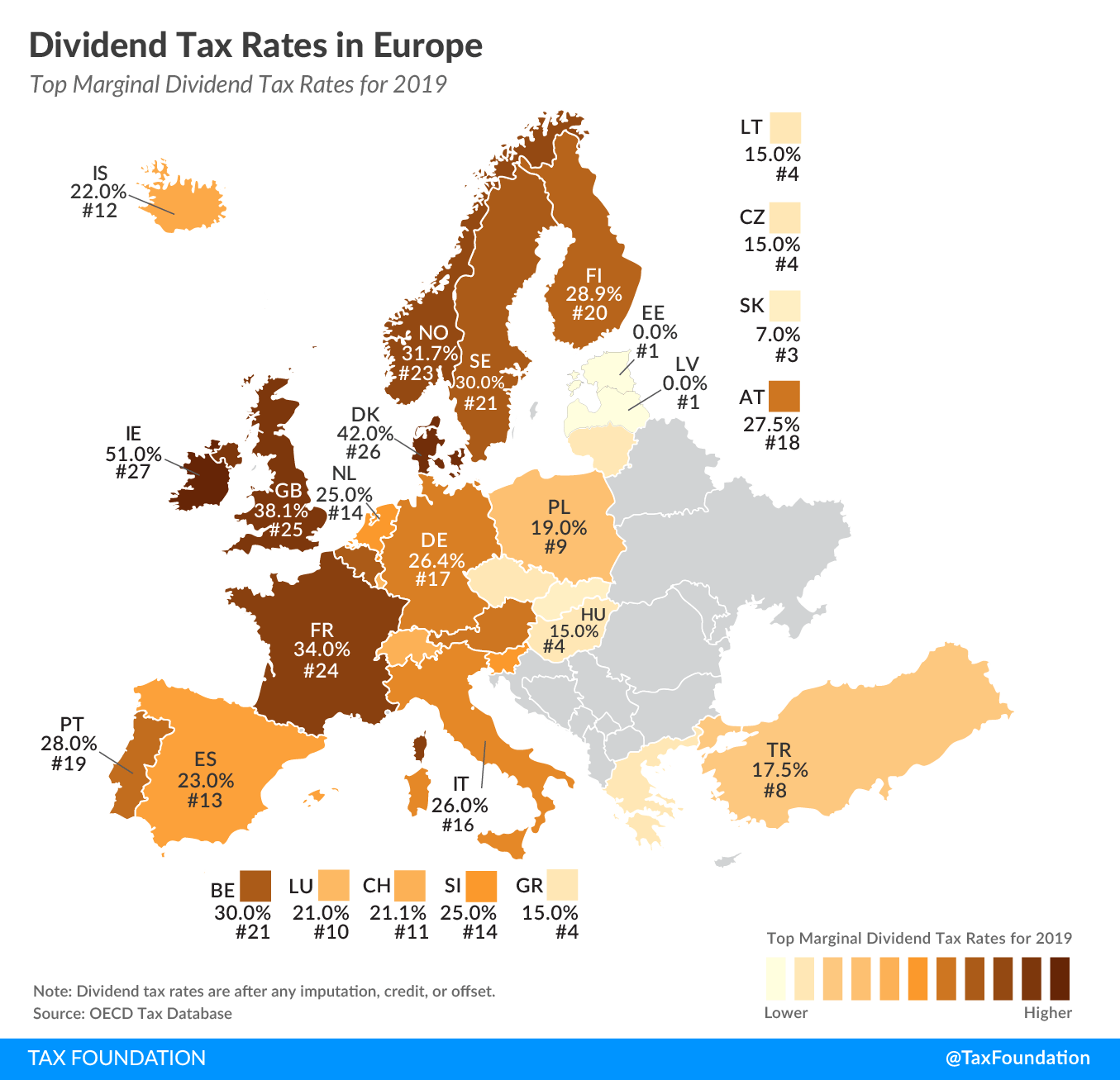

Tax rates on dividends vary widely across European countries. The following chart shows the dividend tax rates across countries:

Click to enlarge

Source: Dividend Tax Rates in Europe, Tax Foundation

Note: The dividend tax rates shown above are expressed as the top marginal personal dividend tax rate, taking account of all imputations, credits, or offsets.

Ireland has the highest dividend taxes at 51%. Denmark and the UK have the next highest rates at 42% and 38.1% respectively.

Estonia and Latvia do not levy any taxes on dividend income,

Among the countries that levy taxes, Slovakia has the lowest rate at 7%.

Overall average tax rates on dividends of about 23% in Europe is much higher than the US rates.