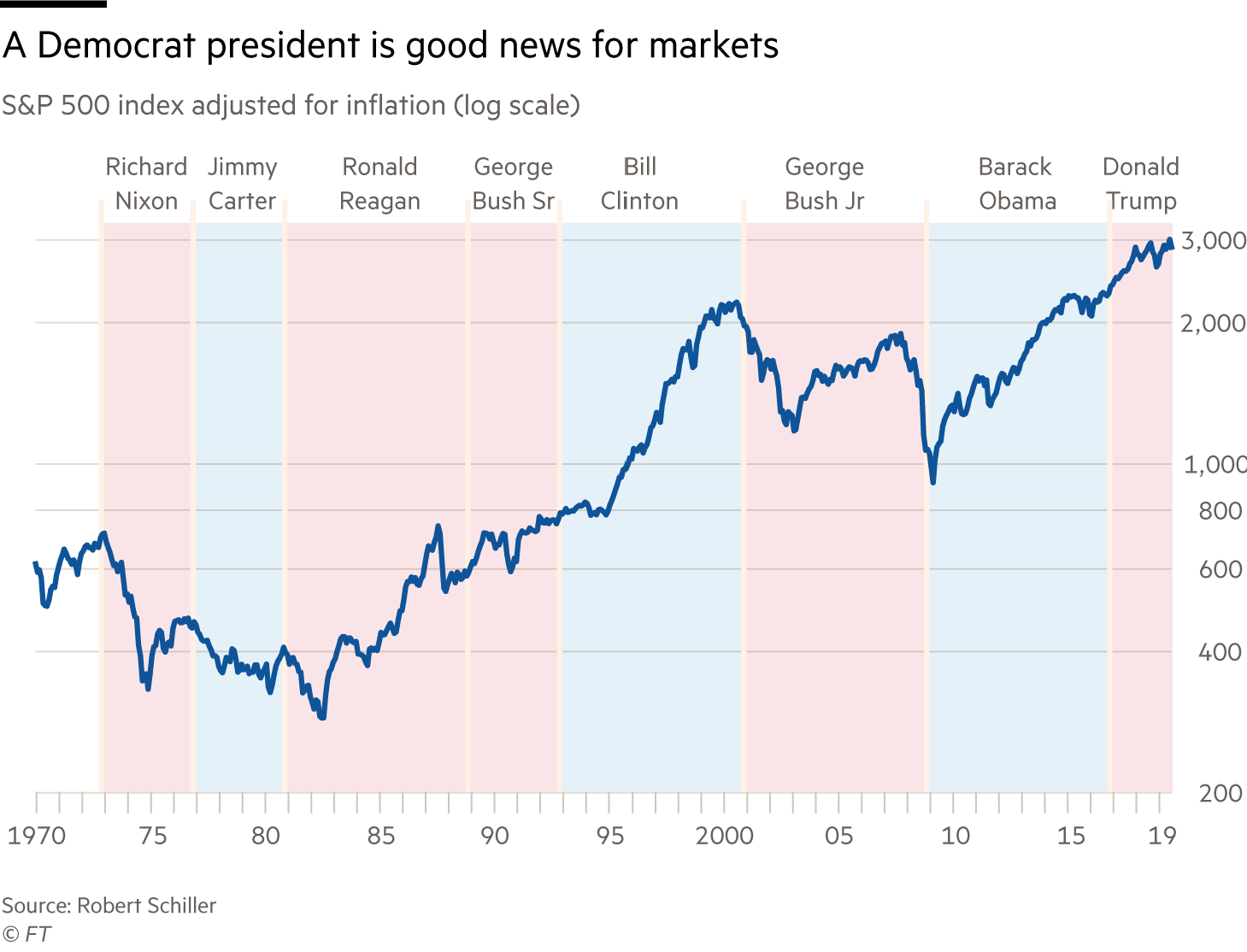

US equity markets tend to perform better when a democrat is president than a republican president. During republican administrations economy tend to be stagnant or have lackluster growth. During democrat presidents’ administrations the economy tends to grow leading to higher stock market returns.

From an article in FT Alphaville quoting a recent working paper by Lubos Pastor and Pietro Veronesi of Chicago’s Booth School of Business:

Stock market returns in the United States exhibit a striking pattern: they are much higher under Democratic presidents than under Republican ones. From 1927 to 2015, the average excess market return under Democratic presidents is 10.7% per year, whereas under Republican presidents, it is only −0.2% per year. The difference, almost 11% per year, is highly significant both economically and statistically

And here’s a neat chart our graphics team put together showing the S&P 500’s performance under various presidents, going all the way back to 1970:

Figuring out why Dems garner the best returns has largely escaped academia, leading to economists dubbing the issue the “presidential puzzle”. (There is also a significant gap in GDP growth — 3.2 per cent, in case you were wondering.)

Pastor and Veronesi reckon it’s all about timing. Republican presidents often get elected when expected returns are low and vice versa. This is because Democrat presidents tend to take office when the economy is weak, and therefore risk aversion is high. As the economy recovers, consumers and businesses begin to regain confidence, and take on more risk — whether in the form of spending, or investment.

A great example would be Obama’s presidency. He inherited a distressed economy and stock market off Dubya which, arguably, would always recover. Still, a return of 182 per cent in the S&P 500 is nothing to be sniffed at. (We also note that many predicted a further stock market crash under Obama in 2008, but there we go.)

Source: Masters of the universe, don’t be scared of Elizabeth Warren, FT Alphaville