Market Timing can be very dangerous to an investor in terms of losing out on potential returns. I have written many articles before on the cons of market timing.

Over and over again this concept has been proven wrong. For example in December 2018 US equity markets fell dramatically wiping out most of the gains of the year. Investors that sold out lost as stocks rebounded sharply since the start of this year and erased all the December losses.

Recently I came across an article by Matthew Young where he showed the dangers of market timing with a great chart. From the article:

The Dangers of Market Timing

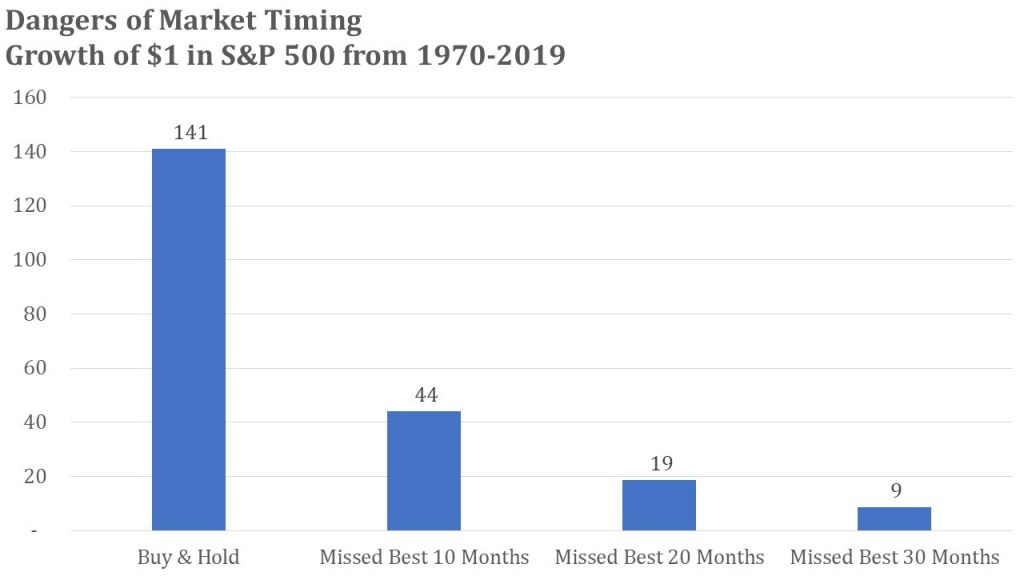

The chart below highlights the dangers of market timing.

If a buy-and-hold investor put $1 in the S&P 500 at the end of January 1970, he would have $141 today. If that same investor tried to time the market but missed the best 10 months, he would have $44 today. If he missed the best 20 months, that $1 would be worth a mere $9 today. Market timing not only risks losing out on significant gains, but it also risks missing vital dividend payments.

Source: A Simple But Effective Strategy to Compound Wealth, Young Investments

The key takeaway for investors is that timing the market does not work and time in the market is more important for success in the long run.