The Zimbabwe Stock Market fell 98% in one week and was shut down during the hyperinflation years of former dictator Mugabe. This is a shocking fact that some investors may not know.

Below is a short excerpt from an article at Research Affiliates:

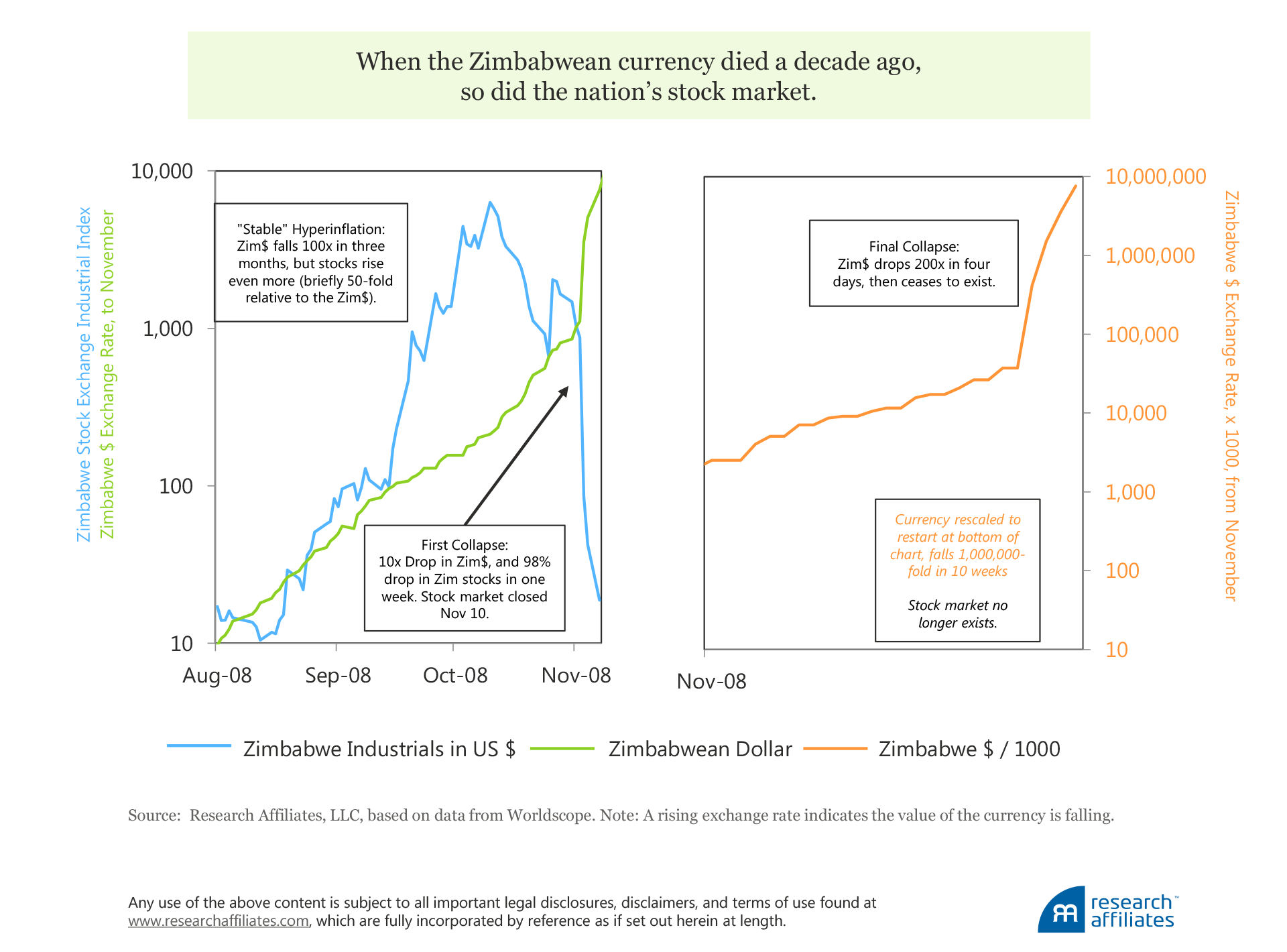

During the three months August–October 2008, the Zimbabwean dollar plunged from 10 to 1000 per the US dollar, a 100-fold currency collapse. At first, the Zimbabwean stock market was unfazed, rising 500-fold in just eight weeks, while the currency fell 10-fold. Thus, in US dollar terms, the stock market rose an astounding 50-fold over those eight weeks. In the next two weeks, however, the stock market toppled 85% and the currency tumbled another 3-fold. Adjusted for the plummeting Zimbabwean currency, the nation’s stock market plunged 95% in two weeks.

Then, both the currency and the stock market ratcheted up volatility another order of magnitude. When the hyperinflation went into overdrive, with purchasing power falling 90% in less than a week, the stock market fell 98% (99.8%, in US dollar terms) in that same week. The stock market in Zimbabwe then ceased to exist.

Suppose we had the clairvoyance to know the market was going to fall 99% in US dollar terms over that three-month period in 2008. And suppose we could have sold the Zimbabwean market short. The strategy would seem to be a no-lose proposition. But not so fast. Even with the prescience of knowing the market was going to zero in three months, by selling short we would have lost 50 times our money, with high odds of bankruptcy, even though we were eventually proven correct!

Whereas a bubble is not as hard to identify in real time as is commonly perceived, transforming a bubble into profit, even for investors who correctly discern it, is a tremendous challenge because late-stage bubbles can take valuations into the stratosphere.

Source: Yes. It’s a Bubble. So What?, Research Affiliates