The stock turnover ratio is the highest in China. This is true especially with A-Shares which are for domestic investors and traded in the local currency. The B-Shares are bought by foreign investors and they cannot buy A-Shares. Unlike other markets such as the US where most investors tend to hold for the long-term, Chinese investors tend to be highly short-term oriented. From an article at Allianz Global Investors:

High turnover adds to A-share liquidity

Domestic retail investors in China dominate the market for A-shares and account for more than 80 per cent of daily turnover. With the investment culture in China focused more on momentum and short-term trading, the stock turnover ratio of China A-shares is among the highest in the world. High levels of turnover generally make it easier for investors to buy and sell shares.

China A-Shares Have a High Turnover Ratio

Source: Ten key facts about China A-shares, Allianz Global Investors

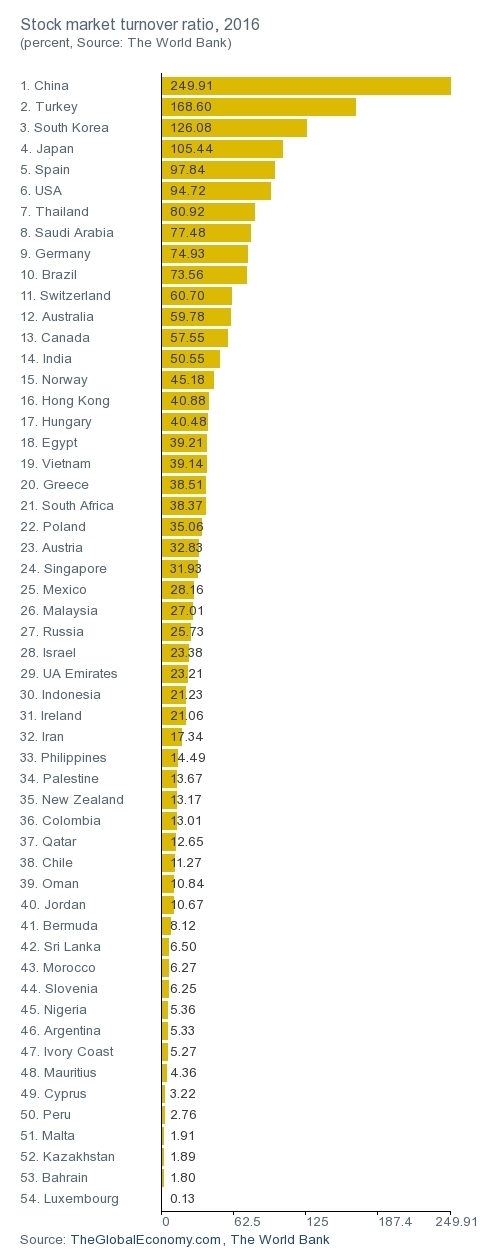

China also ranks the highest in terms of stock turnover ratio when compared to other countries as shown in the chart below:

Click to enlarge

Source: The Global Economy

The key takeaway is that because most investors are retail investors and not institutional investors in China’s A-Shares, the market is prone to wild swings. For example, in a down market retail investors tend to panic at a faster rate and also engage in extreme speculation in a rising market.