The S&P/ASX 200 is one of the main benchmark index of the Australian equity market. The index is comprised of 200 largest firms by float-adjusted market capitalization.

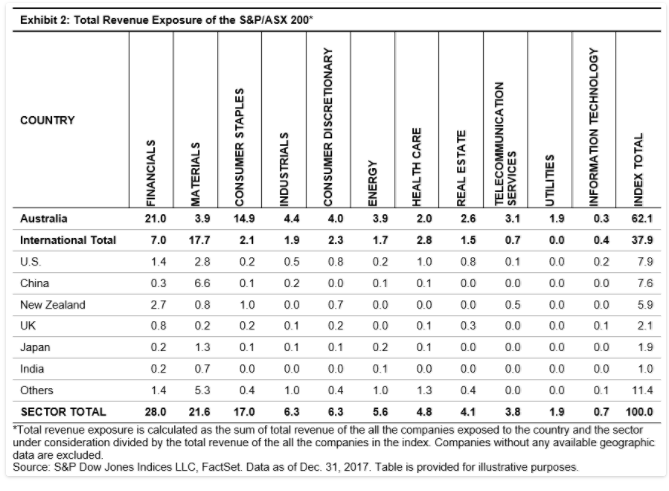

From a sector allocation perspective, over half of the index is made up of financials and materials as shown in the chart below:

Click to enlarge

Source: S&P Indices

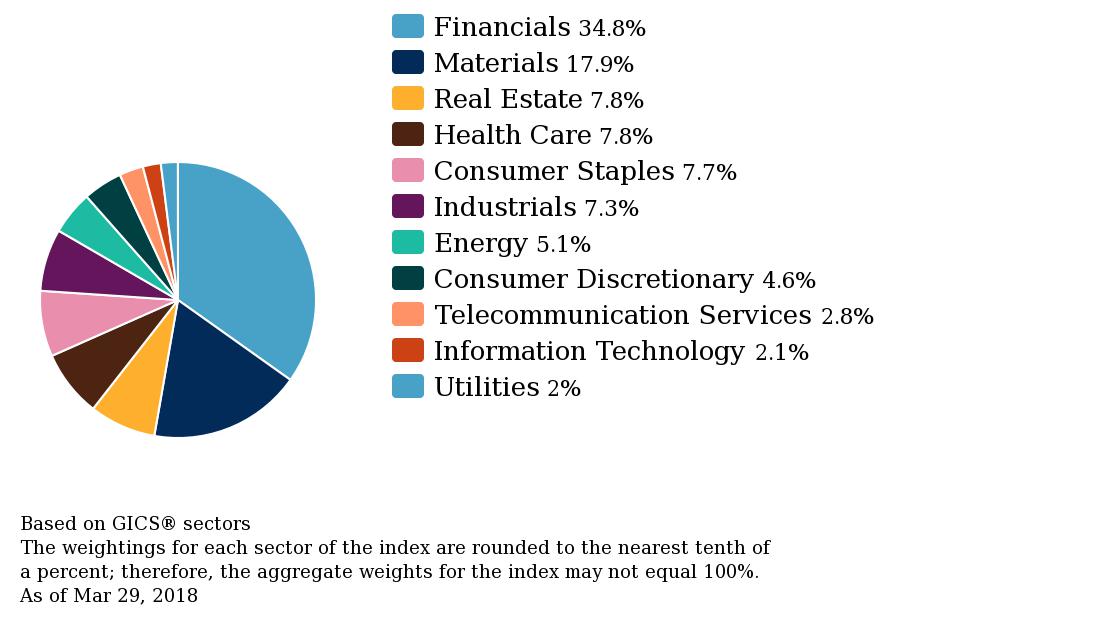

The following table shows the revenue exposure breakdown of the S&P/ASX 200 companies:

Click to enlarge

Source: Revenue Exposure of the S&P/ASX 200 by Utkarsh Agrawal, Indexology Blog

A few observations:

- About 40% of the index’s revenue come from foreign markets.

- The highest revenue exposure is to the US, China and New Zealand.

- Not surprisingly the material sector has the most exposure to foreign countries (18%). For example, most of the coal and iron ore mined in the country are exported to China and other countries.

The key takeaway for investors in Australian stocks is that economic conditions of foreign countries will have an impact of the performance of Australian firms. This is especially true with companies in the material sector where a booming demand for commodities overseas will determine the earnings of Aussie mining firms than the economy of the domestic market.

Related ETF:

- iShares MSCI Australia Index Fund (EWA)

Disclosure: No Positions

Also see: The Components of the S&P/ASX 200 Index