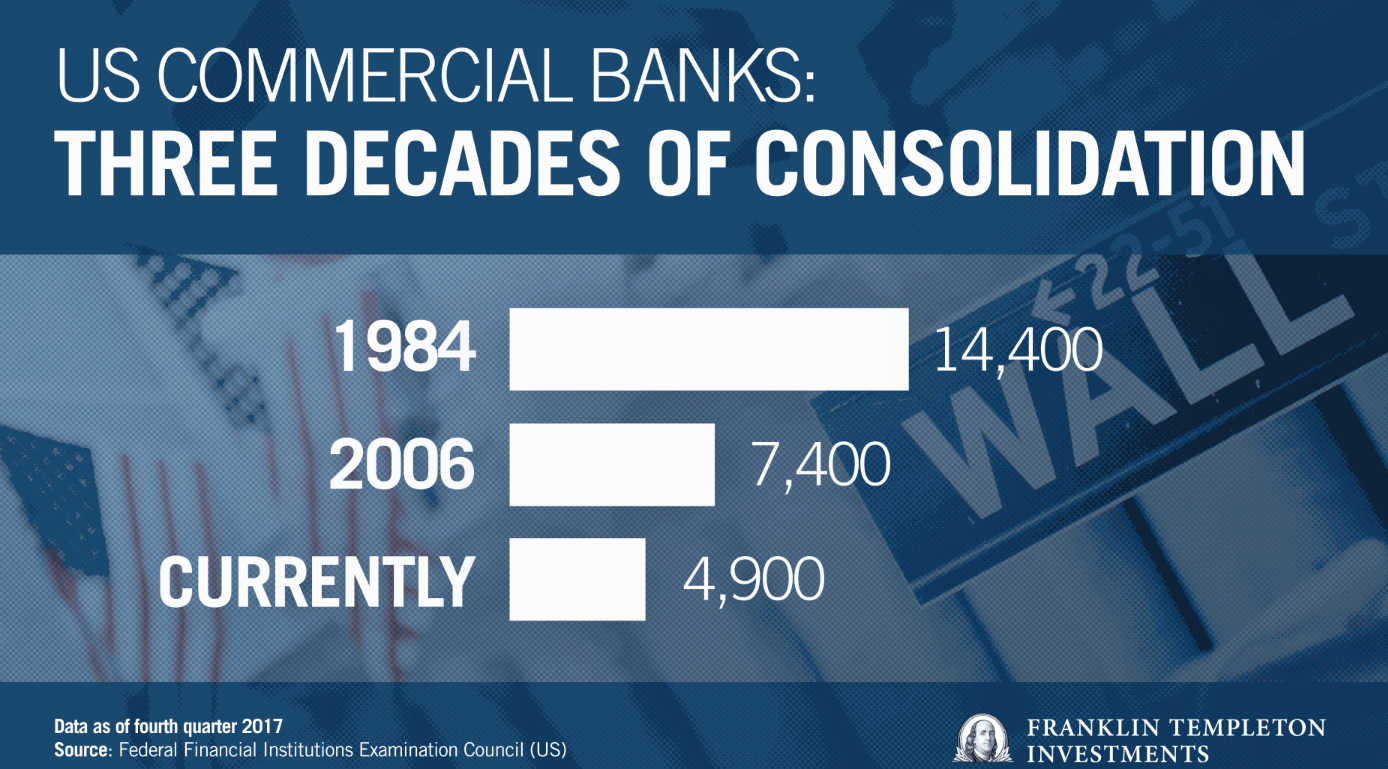

Consolidation in the U.S. commercial banking sector has led to a substantial declines in the number of banks available for banking. According to the Federal Reserve Federal Reserve Bank of St. Louis Economic Research report titled “Commercial Banks in the US.” the number of banks has fallen to 4,900 current. That is a decline of 66% from 1984.

Shawn Lyons, CFA of Franklin Templeton Investments posted an interesting article yesterday on the US banking industry. From the article:

We live in a digital world. Customers have a lot of alternatives to traditional banking. In the United States, there are nearly 5,000 banks.That’s a far cry from the 14,000 or so we had in 1984, and the 7,000 or so we had pre-GFC. But what that does tell us is that we’ve had robust merger-and-acquisition (M&A) activity in the banking industry for quite some time.

M&A does present challenges from a technology standpoint. When you merge two old institutions, the legacy technology usually gets a band-aid to make a square peg fit into a round hole so to speak. You can merge two banks and slap new signage on the buildings, but it’s what’s behind the storefront that is key.

By and large, US banks haven’t traditionally been innovators. Many have technology that is still in the mainframe era, not in the cloud era. So, a lot of these new financial technology (fintech) companies have an advantage in that they can be in real time—their systems can immediately talk to each other. Traditional banks are spending an enormous amount on technology as this area is both a challenge and tremendous opportunity.

Banks have also faced a regulatory burden. However, the trajectory of that burden seems to be reversing (or at least stabilizing) under the new US administration. Banks should now have more money freed up to spend on technology, including competitive types of payment platforms. There are a number of things banks are trying to do with cloud-based technology and transacting in real time. I think fintech is pushing and pulling traditional banks to innovate and to compete.

Source: Banking Sector Under the Microscope, Franklin Templeton Investments, March 20, 2018

The entire piece is worth a read.