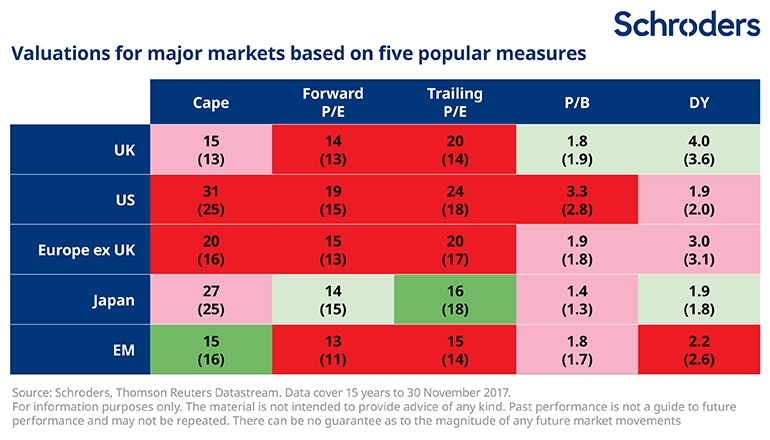

Most equity markets have performed well this year with the US market and major emerging markets increasing by double digit percentages. So investors looking to deploy cash may be wondering which equity markets are cheap as we head into 2018. The following table compares the valuation ratio of global markets:

Click to enlarge

Source: Which of the major stockmarkets are ‘cheap’ going into 2018? by Duncan Lamont, Schroders

From the above article:

The table above(edited) shows a number of valuation indicators compared with their average (median) of the past 15 years, across five different regional equity markets. A description of each valuation indicator is provided at the end.

Figures are shown on a rounded basis and have been shaded dark red if they are more than 10% expensive compared with their 15-year average and dark green if more than 10% cheap, with paler shades for those in between.

As if a glass of red wine has been spilled over it, the table is stained red. With perhaps the exception of Japan, expensiveness abounds. No market is unequivocally cheap so all come with a health warning.

The US market is the most expensive of all the equity markets. However US stocks have always commanded a premium and investors’ attraction to US equities will continue next year. The Japanese market is the cheapest based on the above table but Japan has been cheap for many years now and investors who rushed into Japanese equities have been disappointed over and over in the past.

Overall investors have to be highly selective in the US market and plenty of opportunities exist in developed Europe and emerging countries.